La récente vague d'augmentations tarifaires sur l'éclairage LED chinois a créé une incertitude pour les acheteurs américains et les fabricants chinois. Les importateurs s'inquiètent de la réduction des marges et des prix de vente plus élevés, tandis que les fournisseurs ont du mal à rester compétitifs en raison des coûts de montage. Ces préoccupations vont au-delà des bénéfices à court terme : elles affectent les décisions d'approvisionnement, la stabilité de la chaîne d'approvisionnement et même l'accès des consommateurs à un éclairage abordable et économe en énergie. Alors que les tarifs remodelant les flux commerciaux mondiaux, l'Asie du Sud-Est est devenue un centre de fabrication alternatif, offrant des taux de droits inférieurs mais également de nouveaux défis. Pour les entreprises des deux côtés, il est désormais essentiel de comprendre comment les niveaux tarifaires diffèrent selon l'origine et d'explorer des stratégies pratiques pour contrer les coûts supplémentaires. Cet article examine le paysage tarifaire américain actuel sur les importations LED, compare les tarifs entre la Chine et l'Asie du Sud-Est et décrit les approches de réduction des coûts pour les fabricants et les acheteurs qui naviguent dans cette nouvelle réalité.

Paysage tarifaire américain sur les importations de LED chinoises

Taux tarifaires actuels sur les importations chinoises d'éclairage LED

À la mi-2025, les produits d'éclairage LED importés de Chine, tels que les luminaires et les luminaires, sont soumis à un taux de droit effectif d'environ 30 %. Ce chiffre reflète une combinaison du droit standard américain d'importation dans le cadre de la liste des tarifs harmonisés et des tarifs supplémentaires imposés dans le cadre d'actions commerciales récentes. Les panneaux d'affichage à LED, y compris les murs vidéo et les modules de signalisation, relèvent généralement de structures tarifaires comparables, bien que le taux exact puisse varier légèrement en fonction du code de classification du produit. Pour la plupart des raisons pratiques, les acheteurs doivent s'attendre à ce que les écrans LED attirent un droit dans la même gamme que les équipements d'éclairage LED.

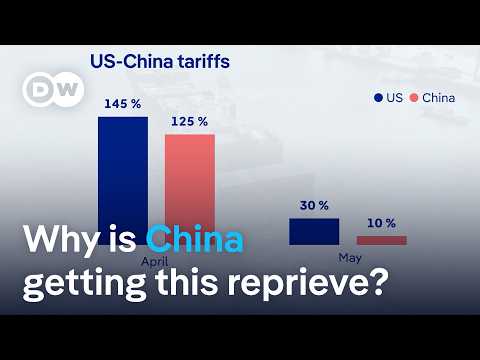

Calendrier des actions tarifaires en 2025

La situation tarifaire est particulièrement volatile depuis le début de 2025. Vous trouverez ci-dessous un résumé des principaux changements de politique affectant les importations en provenance de Chine :

| dater | action | Taux effectif sur les marchandises chinoises |

| 4-Février | Premier cycle de tarifs : 10% s'appliquait largement aux importations chinoises. | 10% |

| 3-mars | supplémentaire 10% ajouté, élevant le total à 20%. | 20% |

| 2 avril | Tarifs « Libération Journée » annoncées : 10% de base plus les suppléments spécifiques aux pays. | 10% + modules complémentaires variables |

| 9-11 avril | L'escalade pousse les tarifs cumulatifs à un pic de 145%. | 145% |

| 12 mai | Accord de Genève conclu : taux américain réduit à 30%; la Chine passe à 10%. | 30% |

| 12 août | La trêve a été prolongée de 90 jours supplémentaires, les droits de la US. | 30% |

Ce calendrier montre à quelle vitesse le fardeau tarifaire a augmenté, passant de 10 % au début de l'année à 145 % en avril, avant d'être ramené au niveau actuel de 30 % en vertu d'une trêve temporaire.

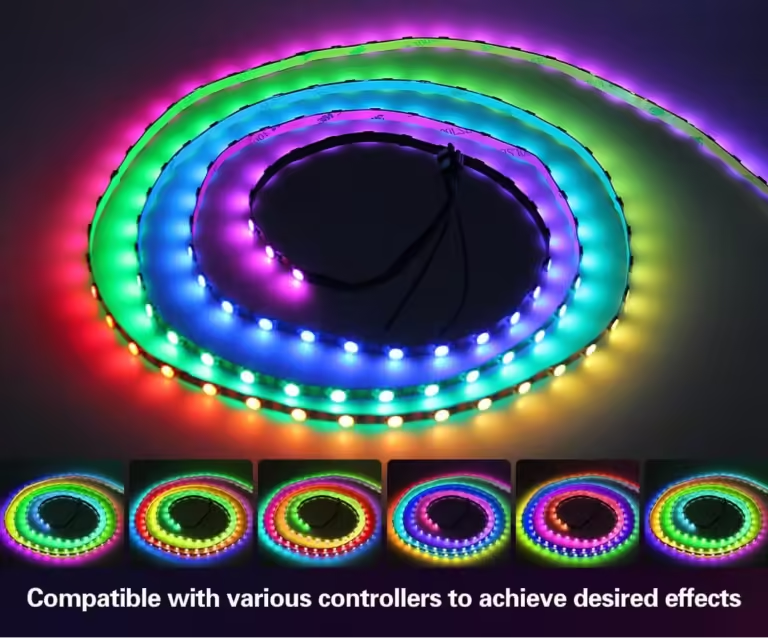

Exemple de calcul de tarif : Lumières de bande LED chinoises

Pour illustrer la façon dont les droits sont appliqués dans la pratique, envisagez une cargaison de feux de bandes LED importés de Chine d'une valeur en douane déclarée de $100.

Droit de base (taux HTS) : 2% de $100 = $2

Section 301 / Tarif réciproque : 30% de $100 = $30

Droits à payer total = $2 + $30 = $32

Cela signifie que le coût de débarquement après les tarifs devient $132, représentant un taux de droits effectifs de 32% sur la valeur déclarée.

Dans certains cas, les importateurs sont également confrontés à ce que l'on appelle « empilement tarifaire », où des surtaxes supplémentaires sont superposées aux droits de base. Bien que tout cela ne s'applique pas à l'éclairage LED aujourd'hui, le risque demeure que de nouveaux tarifs spécifiques à une catégorie pourraient être introduits à l'avenir, ce qui augmente encore le fardeau des importations totales.

Comparaison tarifaire : Chine contre Asie du Sud-Est

Tarifs actuels d'Asie du Sud-Est

Alors que les produits d'éclairage LED chinois sont confrontés à un taux effectif d'environ 30 %, plusieurs pays d'Asie du Sud-Est bénéficient de droits nettement moins élevés lors de l'exportation de marchandises similaires vers les États-Unis. À la mi-2025, les taux moyens estimés sont les suivants :

Vietnam : 15%

Cambodge : 10%

Malaisie : 12%

Thaïlande : 14%

Ces chiffres sont nettement inférieurs au niveau de droits actuels sur les exportations chinoises, ce qui fait de l'Asie du Sud-Est une option d'approvisionnement de plus en plus attrayante pour les importateurs américains.

Tableau tarifaire comparatif

Le tableau suivant met en évidence la disparité des charges tarifaires entre la Chine et les pays sélectionnés de l'Asie du Sud-Est :

| pays exportateur | Tarif effectif moyen sur l'éclairage LED aux États-Unis | Avantage relatif par rapport à la Chine |

| Chine | 30% | — |

| Vietnam | 15% | −15% |

| Cambodge | 10% | −20% |

| Malaisie | 12% | −18% |

| Thaïlande | 14% | −16% |

Cette comparaison côte à côte montre comment l'approvisionnement de la même catégorie de produits en provenance d'Asie du Sud-Est peut entraîner des économies de droits de 15 à 20 points de pourcentage par rapport à l'importation directement de Chine.

Déménagement de fabrication en Asie du Sud-Est

De nombreuses sociétés d'éclairage chinoises ont commencé à adopter une stratégie « Chine plus un » en établissant des usines ou des opérations d'assemblage en Asie du Sud-Est. En déplaçant une partie de leur production vers des pays comme le Vietnam ou le Cambodge, ces entreprises peuvent profiter de tarifs tarifaires plus bas tout en maintenant l'accès au marché américain. En pratique, cette approche réduit non seulement le fardeau tarifaire, mais peut également diversifier les chaînes d'approvisionnement, atténuer les risques politiques et attirer les acheteurs américains à la recherche d'alternatives en dehors de la Chine. Cependant, la mise en place de nouvelles bases de production nécessite un investissement prudent, une formation sur la main-d'œuvre et le respect des règles d'origine locales pour être admissible à un traitement tarifaire préférentiel.

Risques de transbordement en Asie du Sud-Est

Parallèlement à une véritable relocalisation, certains exportateurs ont tenté d'expédier des produits LED fabriqués en Chine en Asie du Sud-Est pour un simple reconditionnement ou un réétiquetage avant de se réexporter aux États-Unis. Cette pratique, connue sous le nom de transbordement, est étroitement surveillée par les douanes et la protection des frontières des États-Unis. Si elles sont détectées, les marchandises sont reclassées comme étant d'origine chinoise et soumises au taux de droits de douane complet, souvent avec des pénalités supplémentaires ou des droits rétroactifs jusqu'à 401 TP3. Au-delà des pertes financières, le transbordement comporte des risques de réputation pour les exportateurs et les importateurs, car les chaînes d'approvisionnement doivent respecter des normes de conformité strictes. Pour cette raison, les entreprises sont de plus en plus conscientes que seule la réinstallation légitime de la production, et non la simple réorientation des flux commerciaux, apporte un allégement tarifaire durable.

Impact sur les fabricants chinois et les acheteurs américains

Pressions sur les fabricants chinois

La hausse des tarifs sur les produits d'éclairage LED a déplacé le pouvoir de négociation vers les acheteurs américains. Les importateurs utilisent désormais des droits plus élevés comme levier pour exiger des prix plus bas, ce qui érode les marges des fournisseurs. Pour de nombreux exportateurs chinois, cela signifie absorber les coûts qui ont été répercutés, ce qui a un impact direct sur la rentabilité.

Le paysage concurrentiel s'est également resserré. Les petites usines avec des ressources limitées sont les plus vulnérables, car même des différences de prix mineures peuvent décider qui obtient une commande. Dans de nombreux cas, ces entreprises risquent de perdre des clients à long terme ou d'être complètement expulsées du marché.

Les grands fabricants réagissent avec des stratégies de diversification, souvent appelées « Chine plus un ». En augmentant la capacité au Vietnam, au Cambodge ou dans d'autres pays d'Asie du Sud-Est, ils réduisent l'exposition aux tarifs américains tout en conservant leur base établie en Chine.

Pourtant, la réinstallation comporte des risques importants. Les usines chinoises sont confrontées au défi de la stabilité de la main-d'œuvre, tandis que les nouvelles installations à l'étranger exigent de nouvelles pratiques de gestion et des ajustements de la chaîne d'a Les coûts logistiques supplémentaires, les exigences de certification et l'incertitude de la politique commerciale américaine augmentent tous la complexité opérationnelle. Pour de nombreuses entreprises, la décision de diversifier est moins une question de profit immédiat et plus une question de survie à long terme.

Pressions sur les acheteurs américains

Pour les importateurs et distributeurs américains, des tarifs plus élevés se traduisent par un fardeau de coûts immédiat. Chaque conteneur qui arrive d'Asie a désormais des droits supplémentaires, obligeant les entreprises à absorber les dépenses ou à les faire passer dans la chaîne d'approvisionnement. Sur un marché où la sensibilité aux prix est élevée, la hausse des prix de détail risque de perdre des clients au profit de concurrents ou de substituts moins chers.

Les petits importateurs, en particulier, sont confrontés à des défis de liquidité. Ils peuvent ne pas avoir la mémoire tampon financière pour payer les droits de douane tout en attendant des mois pour récupérer l'argent grâce aux ventes. Cette situation a renforcé les conditions de crédit et une flexibilité limitée dans la planification des stocks. Les gros distributeurs peuvent gérer la pression plus efficacement, mais même eux constatent des marges réduites et un ralentissement des ventes.

L'incertitude de la politique commerciale américaine ajoute une autre couche de difficulté. Les acheteurs hésitent à s'engager dans des contrats à long terme, sachant que les tarifs pourraient changer en quelques mois. En conséquence, les stratégies d'approvisionnement évoluent, de nombreuses entreprises testant des fournisseurs au Vietnam, en Thaïlande ou au Mexique pour équilibrer les coûts. Pour les acheteurs, la gestion de cette volatilité est devenue non seulement une question de contrôle des coûts, mais également de survie sur un marché en évolution rapide.

Stratégies pour atténuer l'impact tarifaire

Stratégies pour les fabricants chinois

Pour faire face aux pressions tarifaires, de nombreux fournisseurs chinois de LED adoptent un modèle « Chine Plus One ». Les fonctions de base telles que la R&D, l'ingénierie avancée et la fabrication de précision restent en Chine, tandis que la production à forte intensité de main-d'œuvre et à volume élevé est transférée vers l'Asie du Sud-Est. Cette approche permet aux entreprises de protéger leur avantage technologique tout en réduisant l'exposition tarifaire.

Un autre ajustement clé réside dans l'optimisation de la chaîne d'approvisionnement. La création d'écosystèmes d'approvisionnement et de composants localisés au Vietnam, au Cambodge ou en Thaïlande contribue à rationaliser les opérations et à réduire la dépendance vis-à-vis des fournisseurs basés en Chine. Au fil du temps, cela peut réduire les coûts et améliorer la résilience face aux perturbations axées sur les politiques.

Les modèles logistiques évoluent également. Certains exportateurs préfèrent désormais les accords DDP (Doubles payés) où le fournisseur gère le dédouanement et les droits au nom de l'acheteur. Cela réduit non seulement le fardeau financier du client, mais renforce également les relations fournisseurs-acheteurs en offrant des coûts de débarquement prévisibles.

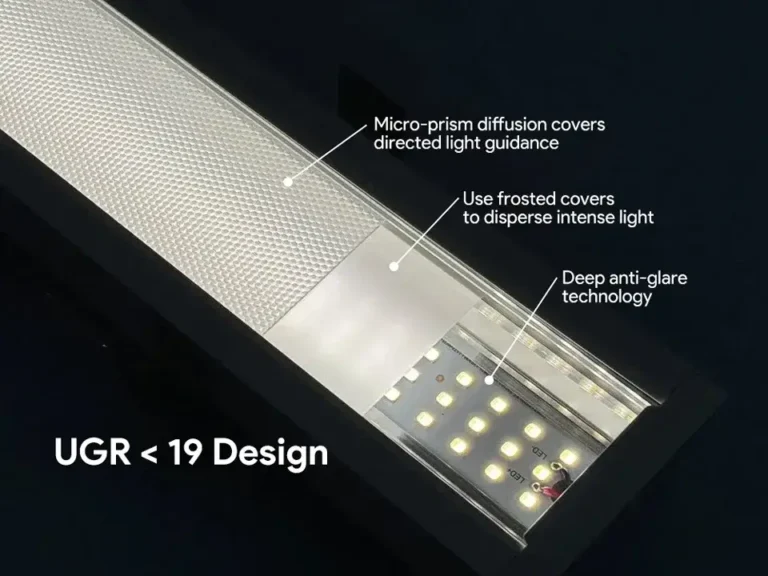

Du côté des produits, un changement vers des offres de plus grande valeur est essentiel. Plutôt que de ne pas concurrencer uniquement les prix, les fabricants font la promotion de systèmes d'éclairage intelligents, de solutions de projet intégrées et de produits personnalisés. De telles stratégies aident à isoler les entreprises des guerres de prix axées sur les produits de base.

Enfin, la résilience à long terme dépend de la diversification de la marque et du marché. La création de sites Web en anglais, l'investissement dans la promotion Google et l'amélioration de la présence du référencement deviennent des pratiques standard.

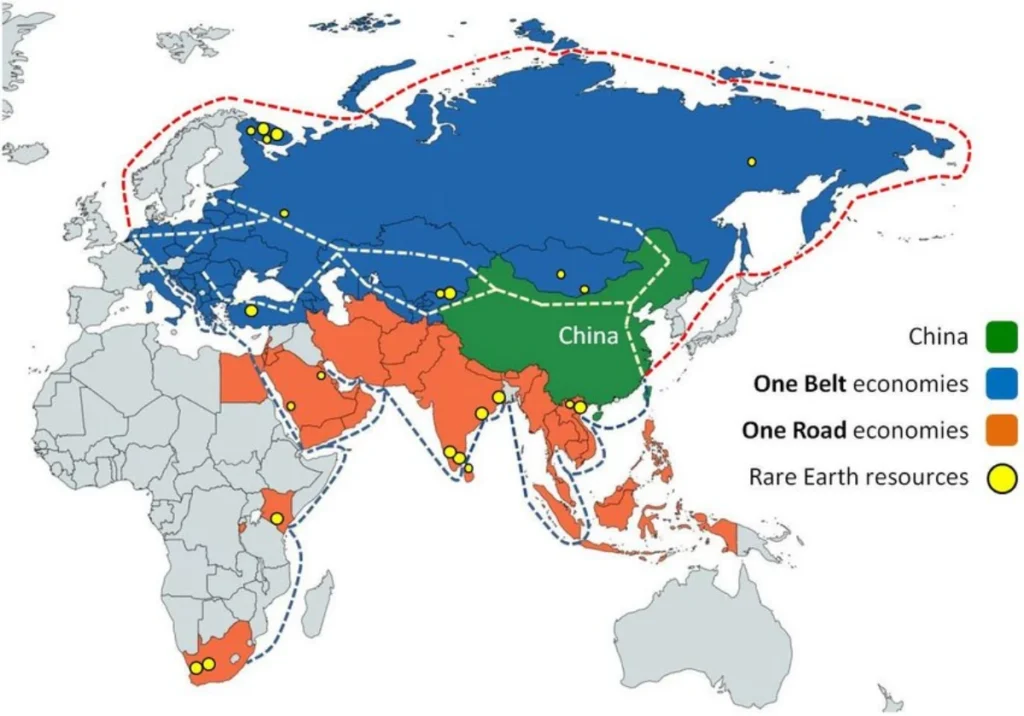

Parallèlement, les fournisseurs explorent activement la demande dans les régions émergentes telles que les marchés de la ceinture et de la route et du Sud mondial, où les barrières tarifaires sont plus faibles et la concurrence moins saturée.

Stratégies pour les acheteurs américains

Pour les importateurs américains, la diversification est devenue une stratégie centrale. De nombreuses entreprises continuent de rechercher des produits LED de haute spécification ou hautement personnalisés en provenance de Chine, où l'expertise technique reste inégalée. En même temps, ils augmentent les achats auprès de fournisseurs d'Asie du Sud-Est, en équilibrant les économies de coûts et la qualité des produits. Cette approche d'approvisionnement « multi-origine » réduit l'exposition aux chocs tarifaires et aux perturbations de la chaîne d'approvisionnement.

La gestion des coûts est un autre levier essentiel. Les acheteurs négocient plus fort avec les fournisseurs, tirant parti de la concurrence sur le marché pour faire baisser les prix. Au niveau du commerce de détail, certains des coûts accrus sont inévitablement répercutés sur les consommateurs grâce à des ajustements graduels des prix. Bien que cela risque de réduire le volume des ventes, cela contribue à maintenir les marges globales sur un marché du resserrement.

La planification des achats a également pris une nouvelle importance. Les importateurs chronométrent soigneusement les expéditions pour éviter les augmentations de tarifs qui se chevauchent, souvent appelées « empilement tarifaire ». Une meilleure rotation des stocks et une gestion plus solide des flux de trésorerie garantissent que les entreprises peuvent absorber des changements de politique soudains sans faire face à des crises de liquidité.

En parallèle, certaines entreprises se tournent vers des mécanismes de secours gouvernementaux. Les programmes qui offrent des exclusions de tarifs temporaires ou des taux de droits réduits offrent une réparation à court terme, bien qu'ils nécessitent une application et une conformité prudentes.

Enfin, un changement vers des catégories de produits à valeur plus élevée est en train d'émerger. Les systèmes d'éclairage intelligents, les rénovations éconergétiques et les solutions de projet avancées offrent de meilleures marges que les bandes ou les luminaires LED de produits de base. En alignant les portefeuilles sur ces segments de valeur plus élevée, les acheteurs américains peuvent compenser les pertes liées aux tarifs et garantir une rentabilité plus résiliente.

perspectives d'avenir

L'environnement tarifaire des produits LED reste incertain, façonné par l'évolution des politiques commerciales et des dynamiques géopolitiques. Alors que les droits actuels ont forcé les fabricants chinois et les acheteurs américains à s'adapter, la tendance à plus long terme est la diversification de la chaîne d'approvisionnement et l'accent mis davantage sur les solutions à valeur ajoutée. L'Asie du Sud-Est va probablement capturer une plus grande capacité de production, mais le rôle de la Chine en tant que plaque tournante pour la R&D et la fabrication de pointe restera essentiel.

Pour les importateurs américains, le défi consistera à équilibrer le rapport coût-efficacité et la stabilité de l'offre, d'autant plus que la demande des consommateurs continue d'évoluer vers un éclairage intelligent et économe en énergie. Les ajustements de politique à Washington, y compris les révisions tarifaires ou les exemptions potentielles, pourraient alléger certaines pressions, mais la volatilité est susceptible de persister. Dans cet environnement, la collaboration entre fournisseurs et acheteurs, basée sur la transparence, la flexibilité et l'innovation, sera la clé du maintien de la compétitivité sur le marché mondial des LED.

La hausse des tarifs a remodelé fondamentalement la chaîne d'approvisionnement d'éclairage LED, impactant les fabricants chinois et les acheteurs américains. Les entreprises qui diversifient de manière proactive la production, optimisent les chaînes d'approvisionnement et se concentrent sur des produits à plus forte valeur ajoutée sont les mieux placées pour relever ces défis. De même, les importateurs américains qui équilibrent l'approvisionnement multi-origine, la gestion des coûts et la sélection stratégique de produits peuvent maintenir leur compétitivité malgré la hausse des tâches.

Dans ce paysage complexe, la collaboration et l'adaptabilité sont essentielles. Travailler avec des fournisseurs expérimentés et flexibles garantit l'accès à des produits fiables tout en minimisant l'exposition tarifaire. SignliteLED propose des solutions sur mesure, des éclairages à LED aux systèmes d'éclairage complets, avec une expertise dans le transport mondial, la conformité et le support de projets. En tirant parti de nos connaissances et de nos ressources, les fabricants et les acheteurs peuvent protéger les marges, réduire les risques et fournir des solutions d'éclairage de haute qualité.

Vous cherchez à exporter des produits d'éclairage du Cambodge et de la Chine vers les régions des États-Unis et du Sud, ainsi que les pays africains.

Bonjour,

Si vous avez besoin d'aide, veuillez nous envoyer un e-mail.