Negli ultimi dieci anni, Strisce LED COB si sono evoluti da prodotti di illuminazione decorativa a sorgenti luminose di base per applicazioni professionali. Con la crescente domanda dei settori della vendita al dettaglio, commerciale, medica e architettonica, l'elevata CRI, l'elevata efficacia e la bassa SDCM sono diventati parametri di riferimento delle prestazioni fondamentali per le strisce LED COB. Allo stesso tempo, una catena di approvvigionamento più matura, livelli più elevati di automazione della produzione e l'adozione di nuovi processi come CSP, SCOB e SOB hanno rimodellato il panorama del mercato. Questo articolo esamina la domanda del settore e l'evoluzione della catena di approvvigionamento delle strisce guidate di pannocchie da una prospettiva storica, analizza il mercato attuale, esplora la distribuzione regionale e fornisce approfondimenti sulle tendenze future.

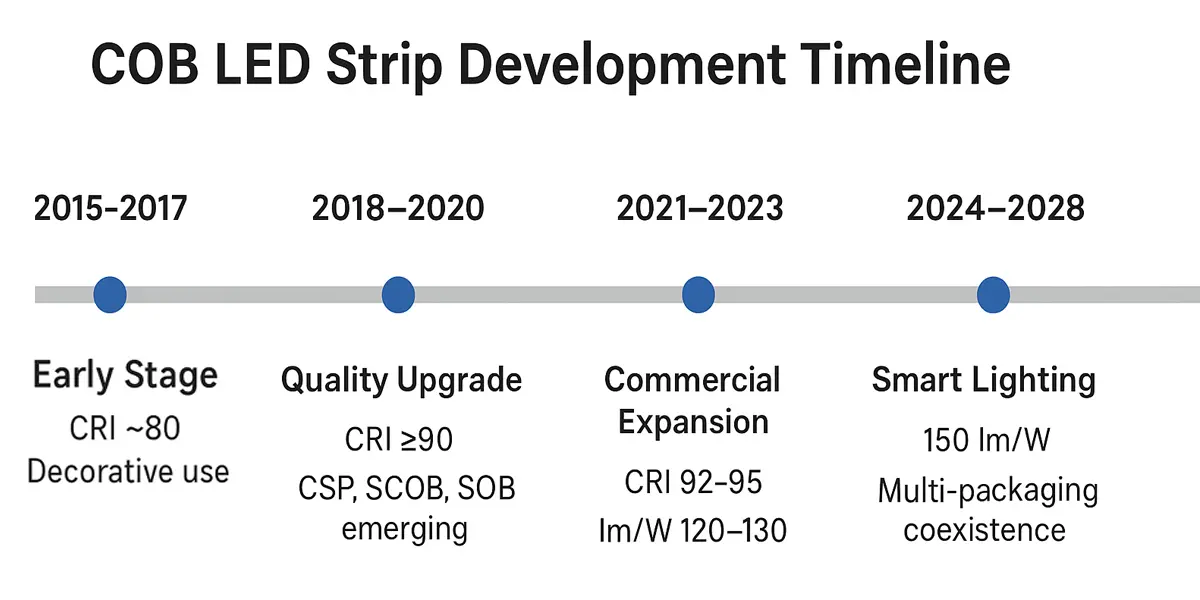

2015-2017: sviluppo iniziale di strisce a LED COB

Tra il 2015 e il 2017, le strisce guidate COB erano nella loro fase iniziale di sviluppo, con applicazioni di mercato incentrate principalmente su illuminazione decorativa, progetti residenziali e segnaletica. Le specifiche tipiche del prodotto durante questo periodo includevano un CRI di circa 80, efficacia di 90–100 lm/W e SDCM ≤5. Sebbene sufficienti per scopi di illuminazione e decorativi di base, questi prodotti non hanno avuto requisiti di illuminazione professionali in termini di qualità e coerenza del colore.

Il vantaggio principale dell'imballaggio di pannocchie era la sua capacità di ottenere un'elevata densità di chip su un singolo substrato, fornendo un'illuminazione uniforme con hotspot e granulosità ridotti. Rispetto alle convenzionali strisce LED SMD, la tecnologia COB offriva una distribuzione della luce più fluida e meno punti luce visibili (vedi tabella di confronto di seguito).

Per maggiori dettagli, leggi la nostra guida sul Differenza tra strisce LED SMD e COB

Tabella (estratto: prestazioni nel 2016-2017)

| Anno | CRI | Efficacia (LM/W) | SDCM | Principali applicazioni |

| 2016 | ~80 | 90–95 | ≤5 | decorativo, segnaletica |

| 2017 | 80–82 | 95–100 | ≤5 | Residenziale, commerciale di base |

Striscia LED COB a emissione laterale

Modello: FYX08S480C

Qtà LED al metro: 480chip (Sanan)

Larghezza PCB: 8 mm

Opzione colore: 2700K/3000K/4000K/6500K

CRI: >90

Tensione di ingresso: DC24V

Potenza per metro: 10W

Efficienza: 90-110 lumen/watt

Grado IP: IP20

Garanzia: 3 anni

2018–2020: aggiornamento tecnologico e miglioramento della qualità

Dal 2018 al 2020, l'industria delle strisce LED COB è entrata in una fase di aggiornamento della qualità critica. Con l'aumento della domanda dei settori della vendita al dettaglio, del commercio e dell'architettura, gli standard di mercato si sono spostati su CRI (≥90), maggiore efficacia (110–120 lm/W) e SDCM più bassi (≤3). Le strisce di pannocchia sono andate oltre l'uso decorativo e sono penetrate negli scaffali dei supermercati, nell'illuminazione degli hotel e negli ambienti degli uffici, dove la coerenza del colore e l'affidabilità erano essenziali.

In questa fase, iniziano a emergere nuovi processi di confezionamento:

CSP (pacchetto scala chip): Riduce la dipendenza dai tradizionali telai di piombo, aumentando l'efficienza e le prestazioni termiche.

Scob (Piccolo/substrato COB): consente una maggiore densità di impaccamento e una migliore uniformità, ideale per un'illuminazione compatta e flessibile.

SOB (silicio a bordo): substrati in silicio a leva per una gestione termica superiore e un'affidabilità a lungo termine, pilotati in alcune applicazioni premium.

Queste innovazioni hanno rimodellato la catena di approvvigionamento: le aziende di confezionamento midstream hanno dovuto aggiornare l'automazione e i test di precisione, mentre i produttori a valle hanno ottenuto l'accesso a fonti di luce più coerenti e stabili. Questo periodo ha segnato il passaggio dall'illuminazione decorativa verso applicazioni commerciali e professionali di fascia alta, gettando le basi per la prossima ondata di scoperte tecnologiche.

Tabella (Performance and Process Evolution 2018–2020)

| Anno | CRI | Efficacia (LM/W) | SDCM | Evoluzione del processo | Principali applicazioni |

| 2018 | 90 | 105–110 | ≤3–4 | CSP introdotto | Vendita al dettaglio, illuminazione a sca |

| 2019 | 90–92 | 110–115 | ≤3 | Scob applicato | Ufficio, illuminazione dell'hotel |

| 2020 | 92–94 | 115–120 | ≤3 | singhiozzante emergente | Commerciale di alta qualità, mostre |

Striscia LED Mono CSP

Modello principale: FYX08C320C

Qtà LED per metro Opzione: 320/480

Opzione larghezza PCB: 8 mm

Opzione colore: 2700K/3000K/4000K/6500K/Rosso/Verde/Blu/Customized

CRI: >90

Tensione di ingresso: DC24V

Potenza per metro: 10W/14W

Efficienza: 100–130 lumen/watt

Opzione grado IP: IP20/IP54/IP65/IP67/IP68

Garanzia: 3 anni

2021–2023: innovazioni di fascia alta

Tra il 2021 e il 2023, le strisce LED COB hanno raggiunto una svolta nelle applicazioni di fascia alta. Poiché il mercato globale dell'illuminazione è passato da strisce di pannocchia "azionate dal prezzo" a "condotte dalla qualità", con una maggiore CRI (≥95), una maggiore efficacia (120–130 lm/W) e SDCM ultra-basso (≤2), è diventata la scelta preferita per l'illuminazione architettonica al dettaglio, sanitaria, museale e premium.

I driver chiave della domanda durante questo periodo includevano:

spazi commerciali e commerciali: Supermercati, negozi di moda e rivenditori di gioielli si sono sempre più affidati a fonti di luce ad alta CRI per garantire una resa cromatica realistica.

Illuminazione architettonica e paesaggistica: Le strisce LED COB flessibili hanno guadagnato terreno grazie alla loro illuminazione continua e senza punti di vista visibili.

Dal lato della catena di approvvigionamento, la combinazione di substrati flessibili e packaging automatizzato è diventata centrale. I produttori a monte si sono concentrati sull'efficienza dei chip e sull'ottimizzazione del fosforo, i packagers midstream hanno migliorato i test di uniformità del colore e i marchi a valle hanno posizionato strisce di pannocchia non solo come componenti ma come parte delle soluzioni di illuminazione a livello di sistema.

2024–2025: attuale panorama del mercato e distribuzione regionale

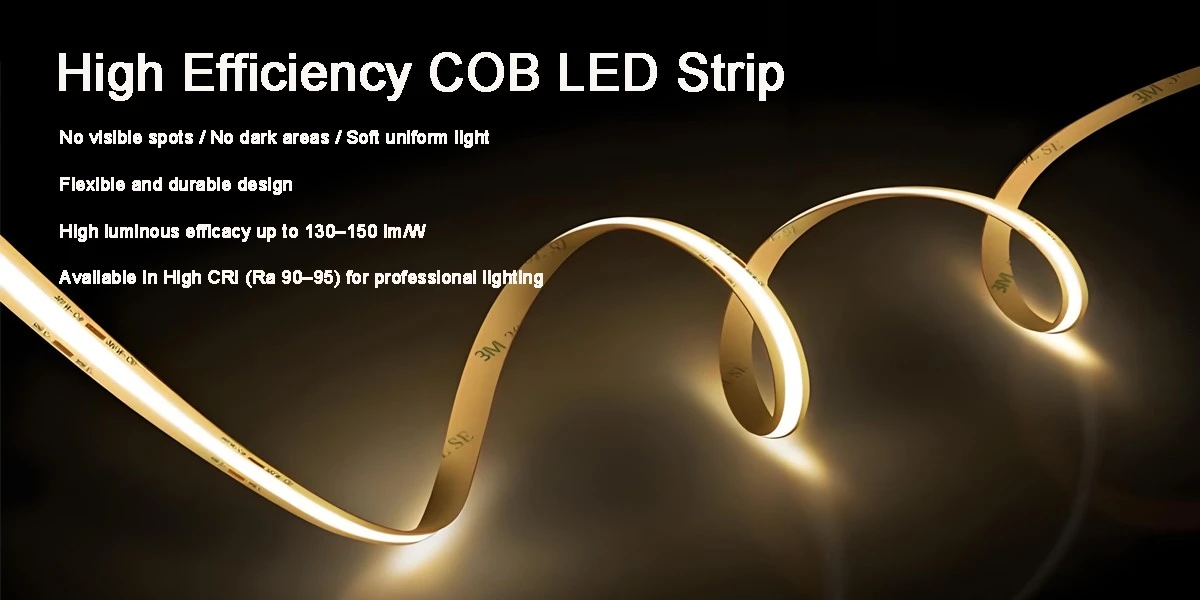

Entro il 2024-2025, le strisce LED COB sono completamente entrate nel range di prestazioni di 130–140 lm/W di efficacia, CRI ≥95 e SDCM ultra-basso (≤2), rendendole una sorgente luminosa di fascia alta mainstream in tutto il mondo. Il mercato mostra diverse caratteristiche chiave:

Livello del prodotto: pannocchie flessibili, design a lunga lunghezza continua e soluzioni di micro-pitch sono ampiamente adottati, al servizio dell'illuminazione intelligente, dell'esposizione commerciale e delle applicazioni architettoniche personalizzate.

Livello della catena di approvvigionamento: i produttori di chip a monte stanno diventando sempre più concentrati, i packager midstream stanno investendo in automazione e test di precisione, mentre i marchi a valle si concentrano sulla fornitura di soluzioni di illuminazione a livello di sistema anziché su strisce LED autonome.

Livello di mercato: la domanda si sta spostando verso la vendita al dettaglio, l'assistenza sanitaria, i musei e l'architettura premium, con chiare differenze regionali.

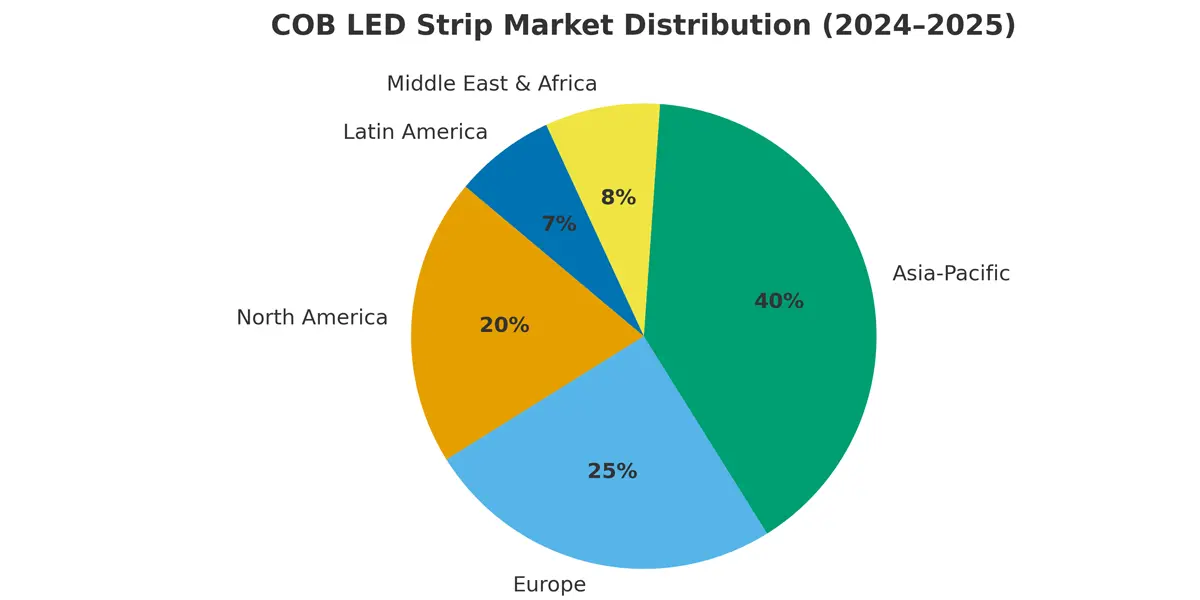

Distribuzione del mercato regionale (2024–2025):

Asia (40–45%): Cina, Corea e Giappone guidano il mercato, spinti da complessi commerciali e case intelligenti. La Cina domina la produzione ed esportazioni flessibili di pannocchie.

Europa (25–28%): forte domanda di alto CRI + SDCM basso nei musei, illuminazione artistica e assistenza sanitaria. La pressione regolamentare sull'efficienza energetica accelera l'adozione.

Nord America (22–25%): Incentrato su catene di vendita al dettaglio ed edifici intelligenti, fortemente dipendenti dalle importazioni, ma con un'elevata accettazione di strisce LED COB ad alta efficacia.

Altre regioni (7–10%): Il Medio Oriente e il Sud-Est asiatico mostrano una rapida crescita, in particolare negli hotel di lusso e nei progetti infrastrutturali.

Tabella (Prestazioni e distribuzione del mercato 2024–2025)

| regione | Condividi | domanda centrale | Applicazioni chiave | Note sulla catena di approvvi |

| Asia | 40–45% | Alta CRI, alta efficacia, flessibilità | Complessi commerciali, case intelligenti, guidate dall'esportazione | La Cina è in testa alla capacità, la Corea/Giappone si concentra sulla qualità |

| Europa | 25–28% | Alto CRI, SDCM basso | Musei, Arte, Sanità | Regolamento spingere per un'elevata coerenza |

| N. America | 22–25% | Alta efficacia, integrazione | Catene al dettaglio, edifici intelligenti | Alta dipendenza dalle importazioni, forte adozione da parte dell'utente finale |

| Altri | 7–101TP3 te | Saldo in termini di costi | Alberghi Medio Oriente, Infrastrutture del sud-est asiatico | La domanda emergente cresce rapidamente |

Nel complesso, il mercato delle strisce di tulibi a LED COB 2024-2025 mostra chiari segni di premimazione, specializzazione regionale e integrazione più profonda del sistema. Leader in Asia in termini di capacità ed esportazioni, l'Europa si concentra sulla qualità della luce, il Nord America dà la priorità all'integrazione ei mercati emergenti si stanno espandendo rapidamente. Queste caratteristiche regionali stanno gettando le basi per un ulteriore consolidamento della catena di approvvigionamento e l'adozione globale.

Striscia luminosa COB LED monocolore

Modello principale: FYX08T480C

Qtà di chip LED per metro: 320/384/480/528chip (Sanan)

CRI: >90

Larghezza PCB: 8mm/10mm

Temperatura colore: 2700K/3000K/4000K/6500K

Tensione di ingresso: DC12V/DC24V

Potenza per metro: 8W/10W/11W/14W

Efficienza: 130-150LM/W

Grado IP: IP20/IP54/IP65/IP67/IP68

Garanzia: 3 anni

2026–2028: prospettive future per le strisce LED COB

Nei prossimi 1-3 anni, le strisce LED COB si evolveranno lungo il percorso di CRI alta, alta efficacia, basso SDCM e flessibilità, entrando in una fase di applicazione matura e ruoli differenziati.

Tendenze di prodotti e tecnologie

Svolta di efficacia: le strisce LED COB dovrebbero raggiungere 140–150 lm/W con CRI ≥95 e SDCM ≤2, che soddisfano gli standard più elevati di vendita al dettaglio, assistenza sanitaria e illuminazione artistica.

Diversificazione dell'imballaggio:

- CSP: compatto, ad alta densità, adatto per illuminazione ultrafine e miniatura;

- Scob: Superiore termico e stabilità, raccordo per uso ad alta potenza e industriale;

- SOB: eccezionale uniformità e durata, ideale per architettura premium ed outdoor;

- Tradizionale pannocchia: rimane dominante nei mercati al dettaglio e sanitario tradizionali.

tavola (pannocchia contro csp vs scob vs. SOB)

| tecnologia | Vantaggi | sfida | applicazioni future |

| PANNOCCHIA | Efficacia e CRI matura, equilibrata | differenziazione limitata | Illuminazione tradizionale, vendita al dettaglio, assistenza sanitaria |

| CSP | Compatto, ad alta densità | Gestione termica, costo più elevato | Illuminazione in miniatura, passo fine |

| frettare | Dissipazione del calore superiore, affidabile | Processo complesso, fornitura limitata | ad alta potenza, industriale |

| singhiozzare | Alta uniformità, durata | Barriera di costo e processo più elevato | Architettura di alta qualità, all'aperto |

Tendenze della catena di fornitura

Upstream: ulteriore consolidamento tra i produttori di chip, con innovazioni di materiali e microstrutture che guidano l'efficienza.

Midstream: l'automazione del packaging e i test di consistenza del colore avanzeranno, con alcuni substrati flessibili e nuovi processi.

A valle: i marchi si concentreranno sull'integrazione a livello di sistema e sull'illuminazione intelligente, posizionando le strisce LED COB come nodi principali negli ecosistemi abilitati all'IoT.

Tendenze della domanda di mercato

Illuminazione intelligente: integrazione con IoT e AI, che consente soluzioni dimmerabili, sintonizzabili e incentrate sull'uomo.

Crescita di fascia alta: assistenza sanitaria, musei e mostre d'arte richiederanno un CRI più elevato e un SDCM più stretto.

Mercati emergenti: Medio Oriente, Sud-est asiatico e America Latina vedranno un'adozione accelerata guidata dalla crescita delle infrastrutture e dell'ospitalità. Dal 2026 al 2028, nel complesso, le strisce guidate COB continueranno ad evolversi insieme a CSP, SCOB e SOB, aprendo la strada a un'adozione più ampia nei mercati di illuminazione di fascia alta e intelligenti.

Conclusione

Nell'ultimo decennio, le strisce LED COB si sono evolute da una tecnologia emergente a una soluzione di illuminazione tradizionale, guidata dai loro punti di forza in CRI, alta efficacia e bassa SDCM. Dalla fase di adozione iniziale intorno al 2015, attraverso gli aggiornamenti della qualità del 2020, alla diversificazione della struttura regionale di distribuzione e catena di approvvigionamento del 2024-2025, l'industria ha dimostrato una chiara traiettoria verso la premiumizzazione, la differenziazione regionale e l'integrazione a livello di sistema.

In attesa del 2026-2028, le nuove tecnologie di imballaggio come CSP, SCOB e SOB completeranno la pannocchia tradizionale, consentendo ulteriori innovazioni in termini di efficienza, affidabilità e diversità delle applicazioni, dalla vendita al dettaglio e sanitarie alle mostre d'arte e agli edifici intelligenti. Allo stesso tempo, la catena di approvvigionamento globale si consolida e la concorrenza passerà sempre più dai singoli prodotti a striscia a LED a soluzioni di sistema complete.

In conclusione, le strisce LED COB rimarranno al centro del settore dell'illuminazione di fascia alta, promuovendo l'adozione globale attraverso l'innovazione tecnologica, l'integrazione della catena di approvvigionamento e la convergenza con gli ecosistemi intelligenti di illuminazione.

Semplicemente non potevo lasciare il tuo sito web prima di suggerire che mi sono davvero piaciute le informazioni standard che una persona fornita sui tuoi ospiti tornerà incessantemente per indagare su CrossCheck nuovi post

Volevo prendermi un momento per elogiarti per l'eccezionale qualità del tuo blog. La tua dedizione all'eccellenza è evidente in ogni aspetto della tua scrittura. Davvero impressionante!