紹介

過去10年にわたり、 COB LEDストリップ 照明業界に革命をもたらし、商業、小売ディスプレイ、インテリアの装飾アプリケーションに好まれるソリューションになりました。 優れた性能を備えた優れた性能を備え、高輝度 (130 ~ 150 lm/w)、優れた演色 (CRI 90+)、均一な光出力を実現するこれらの高度な照明ソリューションは、品質と効率性の新しい業界のベンチマークを確立しています。

世界の COB LED ストリップ市場は、2023 年に約 25 億米ドルに達し、2030 年までに 55 億米ドルに拡大すると予測されており、12% CAGR を表しています。 この成長は、小売りのディスプレイと商業用照明アプリケーションによって特に推進されており、これは合計で 60% 以上の市場需要を占めています。

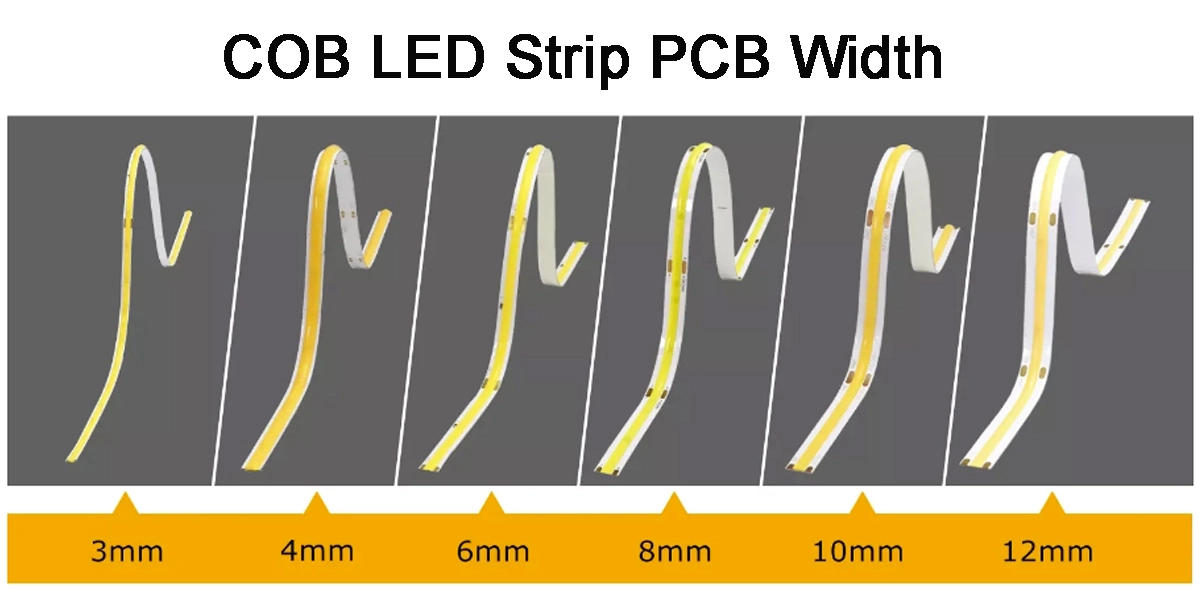

市場の採用が加速するにつれて、グローバルなサプライ チェーンは大きく多様化しています。 PCB 幅 (2.7 ~ 14 mm)、LED 密度 (320-720 チップ/m)、およびパッケージ形式の変動により、購入者にとって機会と複雑さの両方が生じます。 実質的な価格の格差は、基本的な構成の $0.5 からプレミアム仕様の $5 までの範囲で、基本的な品質の違いを反映しています。

これらのバリエーションは、LED チップ グレード、PCB の設計と材料の品質、発光効率、演色指数、色の許容範囲 (SDCM 2-5)、保証条件などの重要な要因に直接起因します。

この分析により、調達チーム、エンジニア、照明指定子に、消費者向け小売および専門の卸売市場の両方の現在の価格設定構造に関する包括的な洞察が提供されます。 このドキュメントでは、材料の選択や生産プロセスから保証ポリシーまで、サプライ チェーンの要因を調べて、最終的に製品のパフォーマンスと総所有コストを決定します。

読者は、主要なソリューションの価格設定とパフォーマンスの比率に関する実用的な情報を取得し、さまざまなアプリケーションにわたる技術仕様の実際的な影響を理解することができます。 このリファレンスは、商業照明プロジェクト、小売店のディスプレイ機能強化、およびボリューム調達シナリオの情報に基づいた意思決定を可能にし、特定のプロジェクト要件と予算の制約に基づいて最適な値を選択します。

C-End と B-End 市場の比較分析と調達ガイド

C-End 小売市場と COB LED ストリップの B エンド エンジニアリング市場は、製品のポジショニング、パフォーマンス ベンチマーク、価格設定に明確な違いを示します。 C-End は、主に個々のユーザーと中小企業を対象としており、透明でアクセスしやすい価格設定を提供します。 対照的に、B-End は、長期的な安定性と総所有コスト (TCO) が重要な考慮事項である大規模なプロジェクトと専門的な照明アプリケーションに焦点を当てています。 これらの違いを理解することで、購入者は製品の選択とコスト管理の両方において、より正確な意思決定を行うことができます。

主要な市場価格要因の比較

C-End 市場の価格設定要因

C-End 市場での価格設定は、主に最初の購入コストと認識された価値によって決まります。

- PCB 幅と密度: 狭いボード (≤8mm) と低密度モデルが優勢で、柔軟な取り付けに適しています。

- 発光効率と CRI: 80 CRI と ~120 lm/w が主流であり、CRI ≥90 の製品は通常、かなりの保険料を運ぶ。

- 色の一貫性: 色の許容範囲 (SDCM) は見過ごされがちなことが多く、バッチ間での潜在的な変動につながります。

- ブランドと保証: 国際的な消費者ブランドは高額の保険料を払っています。 保証期間は通常 1 ~ 3 年で、一貫性のない強制です。

B-END 市場の価格設定要因

B エンド市場での価格設定は、パフォーマンス保証、ライフサイクル コスト、およびプロジェクト リスクの軽減に基づいています。

- PCB 幅と密度: より高密度のより広いボード (8mm、10mm、12mm 以上) が標準で、効果的な放熱と長寿命を保証します。

- 発光効率と CRI: CRI ≥90 (R9 >50) で、140 ~ 160 lm/w を超える高い有効性は、ベースライン要件です。 TM-30-20 (RF, RG) などの高度な指標が重要になってきています。

- 色の一貫性: 厳密な公差要件 (SDCM ≤3、場合によっては 2) 未満の場合は、プロジェクト バッチ全体で正確な色のマッチングを保証します。

- ブランドと保証: 価格設定には、エンジニアリング サポート、グローバル認定、および実証済みの信頼性に対する信頼が反映されています。 保証期間は通常 5 年以上です。

市場のパラメータと価格比較

コア製品のパラメータと価格比較 (5M リール / 24V、480 LED/m、8mm PCB に基づく)

| パラメータ | C-End の標準値 | B-END 標準値 | 注記 |

| 1メートルあたりの料金 | $0.5 – $4.0/M | $1.5 – $2.5/M | C-End には低コストの R が含まれますそしてそしてL-to-Reel 製品 (<$1/M) で、プレミアム ブランドは最大 $4/M に達します。B-End の価格は、保証と認証の費用により、より集中しています。 |

| PCB幅 | 3mm、5mm、8mm、10mm | 8mm、10mm、12mm、14mm | より広い PCB は、B エンド アプリケーションでの放熱と機械的安定性にメリットがあります。 |

| LED密度 | 320-480 LED | 480-720 LED | B-End は、より高いルーメン出力と極度の均一性を追求します。 |

| CRI | 80+ | 90+ (R9 >50) | B-End には、色の忠実度に対する厳しい要件があります。 |

| SDCM | ≤5(/≤3) | ≤3 (/≤2) | B エンドには、バッチの違いを避けるために厳密な色の一貫性が必要です。 |

| 保証 | 1~3年 | 3~5年 | B-End 保証は、パフォーマンスの約束の重要な部分です。 |

| コアバリュー | コストパフォーマンスと利便性 | 信頼性と総所有コスト | 市場のポジショニングと価格設定の基本的な違い。 |

リールツーリールのコブ LED ストリップ

モデル: FYX08S480A/C

1 メートルあたりの LED 数量: 480 チップ

PCB幅:8mm

色オプション: 3000k/4000k/6500k

CRI>80

入力電圧: DC24V/DC12V

1 メートルあたりの電力: 10.5W/m

効率:90~110ルーメン/ワット

IP等級:IP20

保証: 2 年端

側面発光COB LEDストリップライト

モデルFYX08S480C

1 メートルあたりの LED 数量: 480 チップ

PCB幅:8mm

色オプション: 2700k/3000k/4000k/6500k

CRI>90

入力電圧DC24V

メーターあたりの電力:10W

効率:90~110ルーメン/ワット

IP等級:IP20

保証期間:3年

アプリケーションのシナリオと調達に関するアドバイス

C-End の推奨事項

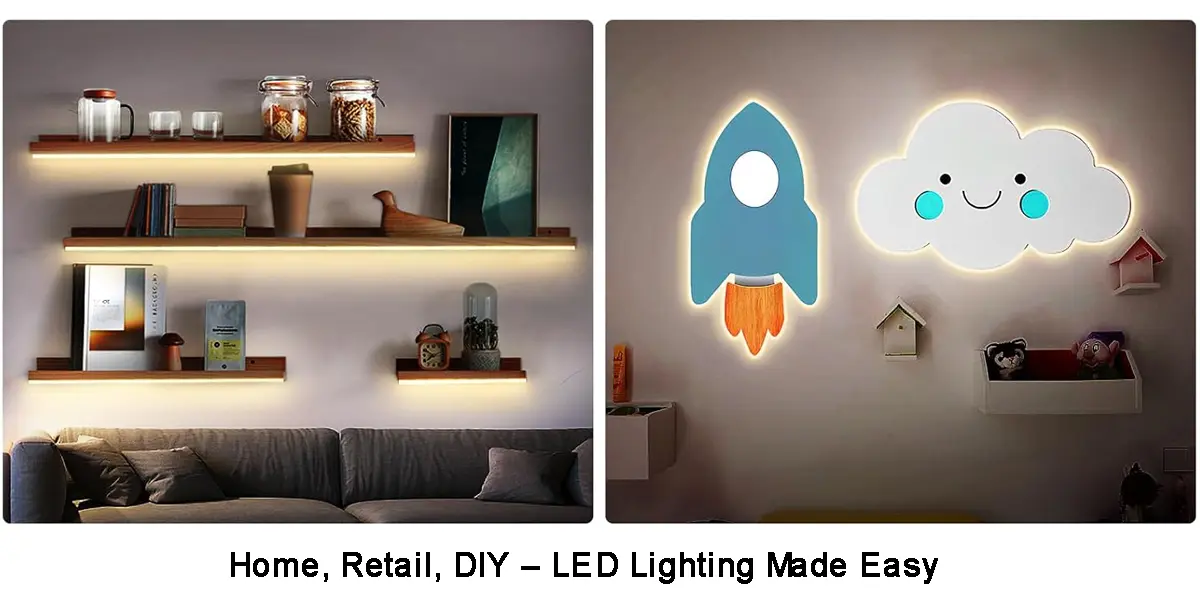

狭いボード/低密度: ホーム キャビネットの照明、DIY 装飾プロジェクト、小さなディスプレイ ケース。

中程度の板 / 中密度: 小さな小売店、カフェ、住宅のアクセント照明。

B-End の推奨事項

ワイド ボード / 高密度: 高級小売店、ホテルの公共エリア、オフィスの線形照明、美術館、ギャラリー。 これらのアプリケーションは、プロジェクトのライフサイクル全体で、完璧な光の品質、信頼性、および安定性を求めています。

サプライ チェーンのコストと価値分析

C-End と B エンドの COB LED ストリップ間の価格差は、チップ ソーシングや PCB 材料からカプセル化プロセスや保証構造に至るまで、サプライ チェーンのあらゆる段階から発生します。 詳細な内訳は、B-End 製品のコストが高いことが、プロのアプリケーションにとって長期的な信頼性と価値につながることを強調しています。

サプライ チェーンのコスト ドライバー

| アスペクト | C-End 特性 | B エンドの特性 | 価値への影響 |

| LEDチップ | ビニングの公差が広い汎用チップ。 | Nichia、Cree、Lumileds などのサプライヤーからのプレミアム チップは、しっかりとビニングされています。 | B エンド チップは、高い有効性、低ルーメン減価償却、および一貫した色を保証し、ソースでのプロジェクトの品質を保護します。 |

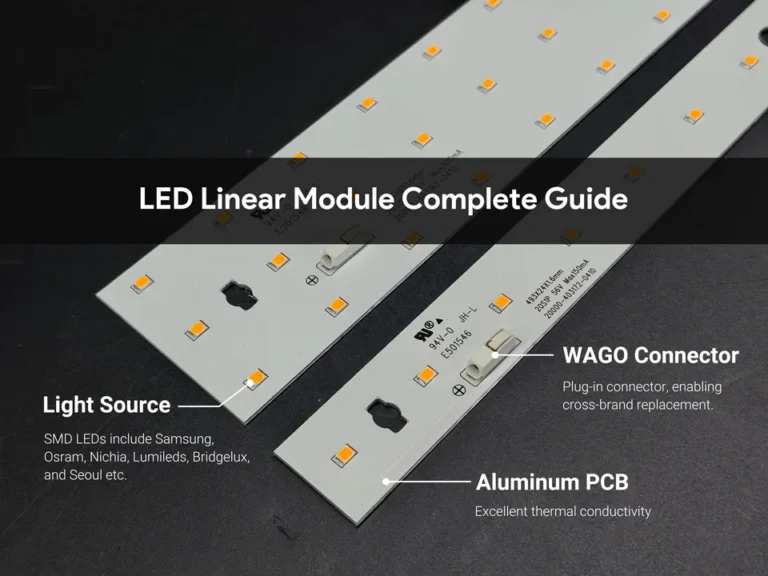

| PCB材料 | 薄い銅 (0.5 ~ 1 オンス) を備えた FR-4 または標準のアルミニウム基板。 | 厚い銅 (2 ~ 4 オンス) を含む高熱伝導性アルミニウム (MCPCB)。 | より厚い銅と先進の基板は、優れた放熱と電流容量を提供し、製品の寿命を直接延長します。 |

| カプセル化 | 標準のエポキシまたは低品位のシリコーンで、黄変や分解が起こりやすい。 | 高透明で、耐老化防止シリコーンで、紫外線や高温に強い。 | B エンド カプセル化により、製品のライフサイクル全体を通して光の透過率と色安定性を維持します。 |

| 生産プロセス | 基本的なダイボンディングとワイヤボンディングは、より緩い公差です。 手動検査が一般的で、カプセル化の一貫性が低下しています。 | 完全自動化された高精度ダイとワイヤボンディング、自動蛍光体噴霧/ポッティング、AOI、100% 光電試験。 | 自動化により、光電の一貫性とワイヤ ボンディングの信頼性が保証され、プロジェクトの均一性に不可欠な、色の変化、ダーク ゾーン、および初期の失敗のリスクが排除されます。 |

| 保証ロジック | 保証は、多くの場合、物理的な障害のみに基づいています。 | 保証はパフォーマンスに関連しており、通常は L70/B50 を 50,000 以上、3 ~ 5 年ルーメンのメンテナンスでメンテナンスを行います。 | B-END 保証は、契約上のパフォーマンス コミットメントとして機能し、TCO とメンテナンスを引き下げます。 |

高度なパッケージング技術: COB とその進化

COB パッケージは、依然として線形照明の主流のソリューションですが、新しい形式に進化し続けています。 これらの革新は、発光効率、熱管理、および光学制御を強化し、バイヤーにさまざまなアプリケーション要件に合わせたオプションを提供することを目的としています。

| 技術 | 説明と特徴 | メリット | 一般的なアプリケーションと市場 |

| COB(チップオンボード) | 複数の LED チップが基板に直接パッケージされ、高密度で連続した光の表面を形成します。 | 目に見える粒状、コンパクトな構造、低熱抵抗のない優れた色の均一性 (直接基板接続)。 | 商業、小売、装飾照明で広く使用されており、C-END と B-END の両方の市場で優勢です。 |

| CSP (チップスケール パッケージ) | パッケージサイズは、チップ自体とほぼ同じで、金線なしで取り付けられています。 小型SMDとして機能します。 | ルーメン密度が高く、熱経路に優れているため、コンパクトな照明器具の設計が可能です。 | 極端な小型化が必要なニッチなアプリケーション (自動車、フラッシュ、プロジェクターなど)。 ストリップ市場でのシェアは非常に小さい。 |

| SCob (フリップチップコブ) | フリップチップ電極を使用して、基板パッドに直接結合した COB を使用し、金線を除去します。 | より高い信頼性 (ワイヤ ボンディングの故障なし)、優れた熱性能により、より大きな駆動電流をサポートします。 | プレミアム B エンドの使用例: 自動車用ヘッドライト、屋外用品、産業用照明。 |

| SOB (シートオンボード) | 1 つの蛍光体シートがチップ アレイを覆い、ディスペンス 蛍光体のりに代わるものです。 | 蛍光体層の不均一を避けることで、優れた色の一貫性、生産を簡素化します。 | 究極の色の均一性が必要な、超ハイエンドのコマーシャル、ミュージアム、フィルム照明。 小さいながらも成長している市場セグメント。 |

最適な調達戦略の策定: コスト分析から価値投資まで

コア意思決定フレームワーク: 総所有コスト (TCO) について

商業照明プロジェクトでは、COB LED ストリップの購入価格は出発点にすぎません。 価値の実際の尺度は、購入と設置からエネルギーの使用とメンテナンスまで、製品のライフサイクルのすべての段階をカバーする総所有コスト (TCO) にあります。 TCO は、投資収益率を評価するためのベンチマークです。

初期購入費用: ストリップ、ドライバー、およびアクセサリーの前払い費用。

インストール費用: 再配線要件など、労力と設置の複雑さ。

エネルギー コスト: 発光効率 (LM/W) と現地の関税に基づく長期電気支出。 高効率製品は、エネルギー節約により、1 ~ 2 年以内に価格差を取り戻すことがよくあります。.

メンテナンスと交換の費用: 保証後の故障率、ルーメンの減価償却による交換、および潜在的なダウンタイムの損失 (多くの場合、最も隠されているが費用のかかる要素) をカバーします。

表: TCO 比較分析例 (5 年周期)

| 原価項目 | 経済オプション | プロのオプション |

| 初期購入費用 | $500 | $1,500 |

| エネルギーコスト | $800 | $600 |

| 維持費 | $400 | $0 (保証期間内) |

| ダウンタイムの推定損失 | $300 | $0 |

| 5年TCO | $2,000 | $2,100 |

調達決定マトリックス: 理想的な製品の特定

調達を簡素化するために、このマトリックスは技術仕様、アプリケーション シナリオ、および予算レベルを調整し、コスト、パフォーマンス、および長期的な価値の間のトレードオフをより透明にします。

表: COB LED ストリップ調達決定マトリックス

| カテゴリー | コスト重視 | バランスのとった | 高性能 |

| 申し込み | ホーム DIY、倉庫、廊下 | 小さなお店、カフェ、オフィス | 高級小売店、ホテル、博物館 |

| キースペック | CRI 80+、SDCM ≤7 | CRI 85+、SDCM ≤5 | CRI 90+ (R9 >50)、SDCM ≤3 |

| 価格帯 ($/M) | $0.5 – $1.5 | $1 – $3 | $2 – $5+ |

| 価値提案 | 最低の初期投資 | 最高のコストパフォーマンス率 | 最低 TCO、リスク軽減策 |

シナリオベースの調達ガイド

プロジェクト オーナーおよび管理者向け: 主力店舗やメイン ホールなどの主要な商業ゾーンの TCO 分析を準備することをお勧めします。 これにより、決定が「費用負担」から「価値投資」に移行し、プレミアム COB LED ストリップの使用が正当化されます。

デザイナーとエンジニアの場合: 技術文書で重要なパラメーター (CRI ≥90、SDCM ≤3 など) を指定し、決定マトリックスを使用して、さまざまなオプションがプロジェクトの結果と運用コストにどのように影響するかを示します。

調達の専門家向け: 「ハイブリッド戦略」を採用する: バランスの取れた製品を二次エリアに展開して予算を管理すると同時に、全体的な品質を確保するためにコア領域の高性能製品を主張します。

市場動向と今後の展望

市場のさまざまな傾向の変化

C-End 市場動向:

コストと品質のバランスを取る: 消費者は、価格主導の決定を超えています。 価格の高感度は依然として高いが、CRI が高い (≥90) とスマート制御機能 (アプリベースの調光とチューニング) の需要は急速に高まっています。

多様なチャネル: オンライン プラットフォームが売り上げを支配し、ビデオ レビューとユーザーの声が購入の決定に影響を与えます。

DIY アプリケーションの成長: パーソナライズされた家庭用照明は、コンパクトで簡単に取り付けられるコブ ストリップの成長を促進します。

B-END 市場動向:

要件の標準化: CRI ≥90、SDCM ≤3、および L90 >50,000 時間 > は、ハイエンド プロジェクトのベースライン仕様になりました。

統合ソリューション: クライアントは、光学設計、インストール ガイダンス、アフターセールス サポートを含むパッケージをますます要求しています。

持続可能性: エネルギー認証、環境に優しい素材、長寿命製品は、ホテル、オフィス、ファサード照明などの商業プロジェクトで ESG の遵守をサポートします。 COB LED ストリップが市場を支配する理由についてさらに詳しく知りたい場合は、次の完全なレポートを参照してください。 2025 年照明のトレンド: 驚くべき COB LED ストリップの台頭.

市場規模、価格、およびメーカーのダイナミクス

生産量の伸び

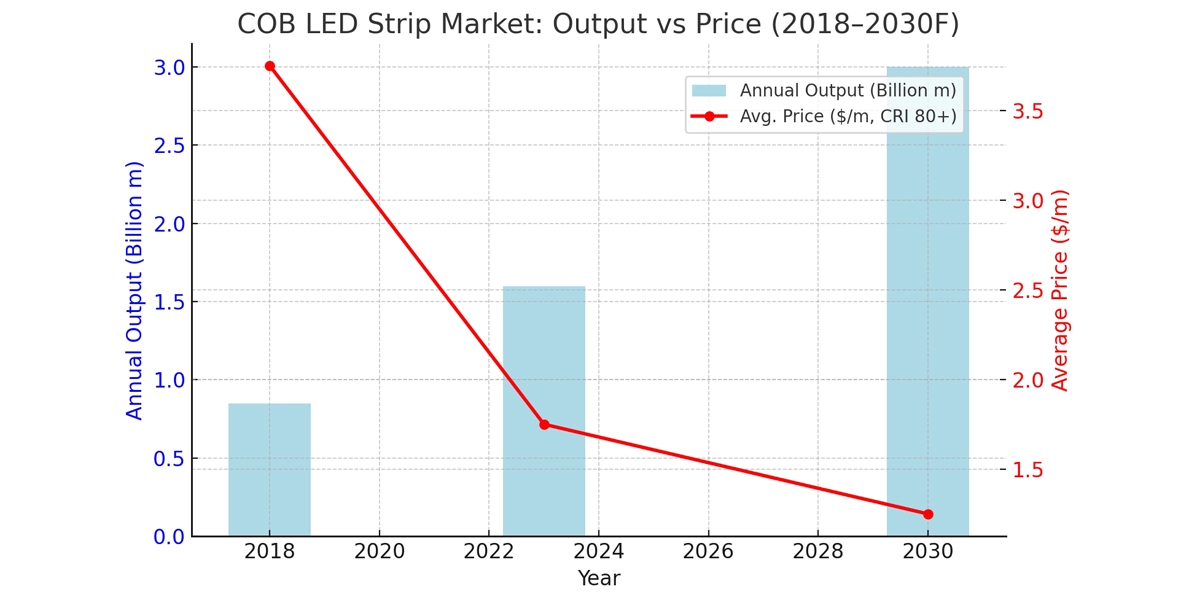

世界の生産量は、2018 年の 8 億 5000 万メートルから 2023 年には 16 億メートルに増加しました。これは、小売および装飾的なアプリケーションによって駆動されます。 2030 年までに、12% CAGR に沿って 30 億メートルを超えると予測されています。

価格の進化

主流の COB LED ストリップ (480 LED/m、8mm PCB、CRI 80+) の平均価格は、規模とロール ツー ロールの製造の経済により着実に下落しています。

- 2018: 1 メートルあたり 3.5 ~ 4.0 米ドル

- 2023: 1 メートルあたり 1.5 ~ 2.0 米ドル

- 2030 年 (予想): 1 メートルあたり 1.0 ~ 1.5 米ドル

プレミアム CRI 90+ 製品は、特に 5 年以上の保証が必要な B-End プロジェクトにおいて、30 ~ 40% の価格プレミアムを維持します。 製品レベルのイノベーションとパフォーマンスの変化を詳しく見るには、次の記事をご覧ください。 COB LED ストリップのトレンド.

サプライヤーのランド

アクティブなメーカーの数は、2018 年の 200 から 2023 年に 400 以上に増加し、主に中国を中心にしています。 2030 年までに、統合により上位 20 のプレーヤーが 60% の市場シェアを保有し、小規模な企業は OEM/ODM の役割に移行します。

表 1: 生産、価格、およびサプライヤー動向 (2018 ~ 2030 年)

| 年 | 年間生産量 (10 億 m) | 平均 価格 ($/M、CRI 80+) | アクティブなメーカー | 市場構造 |

| 2018 | 0.85 | 3.5–4.0 | ~200 | 断片の |

| 2023 | 1.6 | 1.5–2.0 | 400+ | 競争率が高い |

| 2030F | >3.00 | 1.0–1.5 | 連結 (約 20 人) | トップ 20 >60% シェア |

テクノロジーの進化の方向性

効率の向上: チップ設計と蛍光体材料の継続的な改善により、大量生産の有効性が 180 ~ 200 lm/w に向けられています。

色の一貫性のブレークスルー: AI ベースのビニングと SOB パッケージは、SDCM が 1.5 以下で大規模な生産を実現します。

スマート統合: 統合されたワイヤレス チップ、周囲センサー、およびアドレス指定可能な機能を備えた COB ストリップは、スマート照明アプリケーションの境界を拡大しています。

熱管理の革新: セラミック基板と熱電分離構造により、熱管理が大幅に改善され、より高い電力密度設計が可能になります。

パッケージング技術の詳細な比較を含む COB、CSP、SCoB、および SOB—そして、それぞれの構造特性、測光性能、および設置の適応性について、この包括的な購入者ガイドを補足リソースとして参照できます。

新たなアプリケーション分野

農業用照明: 調整可能なスペクトルの穂軸ストリップは、垂直農業と温室栽培のための正確な波長ソリューションを提供します。

医療用照明: 高額なちらつきのない COB 製品は、手術用照明や医療施設にますます適用されています。

自動車用照明: フレキシブル COB ストリップは、自動車の室内環境および外部信号照明で急速に採用されています。 フィルムとブロードキャストの照明: CRI と安定性の高い COB ストリップは、映画制作やライブ放送に適したオプションとして浮上しています。

表: 2024 ~ 2030 年の潜在成長市場予測

| 適用エリア | 投影された CAGR | 主なドライバー |

| スマートホーム照明 | 15.20% | 家全体のインテリジェンス、パーソナライズされた照明需要 |

| 垂直農法 | 22.50% | 食品の安全性、ローカライズされた生産 |

| 自動車用室内照明 | 18.70% | EV の採用、パーソナライズされた車内体験 |

| 商業用ディスプレイ照明 | 12.30% | 小売りのアップグレード、ブランドの差別化 |

競争の激しい状況と中国の製造上の利点

グローバルな競争環境

グローバルな COB LED ストリップ市場は、「デュアル トラック競争」構造を形成しています。

フィリップス/シグネファイ、オズラム/レッドヴァンス、クリー

ハイエンドの B-End プロジェクト (ショッピング モール、ホテル、博物館など) に焦点を当てます。 ブランド プレミアムと認証システムで市場シェアを維持していますが、価格は業界平均を大幅に上回っています。

新興ブランドとプラットフォームのホワイト ラベル (Amazon、LEDsupply など)

C-End とミッドからローエンドの B-End 市場の一部を提供します。 透明な価格設定と柔軟な供給が特徴ですが、長期的な安定性とバッチの一貫性に欠けることがよくあります。

中国のメーカー

中国のメーカーは、OEM/ODM モデルを通じて急速に成長し、海外ブランド向けに生産するだけでなく、独自のブランドを構築し、徐々に中流市場に参入しています。

中国の製造業の主な利点

完全なサプライ チェーン

中国は、上流のチップと包装材料から、中流のストリップ生産および下流アプリケーションに至るまで、完全な産業チェーンを確立しており、リードタイムを大幅に短縮し、総コストを削減しています。

コスト競争力

同等の仕様では、中国製の穂軸ストリップは、ヨーロッパやアメリカのブランドよりも一般的に 30 ~ 50% 安く、より高いコストパフォーマンスを提供します。

カスタマイズ能力

スモール バッチのカスタマイズと OEM/ODM サービスをサポートします。サンプルは最短で 1 ~ 2 週間で提供され、迅速な反復と多様な要件に対応します。

認定とコンプライアンス

ほとんどの輸出志向の企業は、CE、RoHS、UL、ETL などの認証を提供し、国際的な市場アクセス要件への準拠を保証します。

ケーススタディとデータサポート

税関の統計によると、中国の LED 照明輸出は 2024 年に 480 億米ドルを超え、COB 線形照明は最も急成長しているセグメントであり、CAGR は 18% を超えると予測されています。

ヨーロッパの小売チェーンと北米のエンジニアリング プロジェクトでは、国際的なブランドの代替または補完として、「Made in China」のコブ ストリップを採用することが増えています。

調達に関する推奨事項

サプライヤーを選ぶとき、顧客は次のコア要因に注目する必要があります。

サプライ チェーンの透明性: 原材料と生産プロセスのトレーサビリティ。

製品の一貫性: CRI や SDCM などの主要なパラメーターのバッチ安定性。

アフターセールスのサポート: 明確で十分に実装された保証ポリシー。

地域の洞察: 地域別の市場特性

北米

ほとんどの商用プロジェクトでは、UL/ETL 認定が必須です。 調達チームは、安全基準と保証の実施に重点を置いています。 価格はヨーロッパやアジアに比べて敏感ではありませんが、リードタイムの信頼性は重要です。

ヨーロッパ

CE、RoHS、および ERP エネルギー基準への準拠は、主要な市場参入のしきい値です。 持続可能性と ESG の整合性が強力な原動力であり、バイヤーは、環境に優しい素材と文書化された炭素削減の取り組みを備えたサプライヤーを好むことがよくあります。

アジア太平洋地域 (APAC)

需要が最も急成長している市場は、小売、ホスピタリティ、スマート ホーム アプリケーションに集中しています。 調達は非常に高額ですが、迅速なカスタマイズと迅速な配送サイクルが高く評価されます。

中東とアフリカ (MEA)

プロジェクトは、過酷な気候条件による耐久性と高温性能を重視しています。 大規模なホスピタリティとインフラストラクチャの開発 (空港、ショッピング モールなど) により、ハイエンド COB ソリューションの需要が高まります。

| 地域 | 認証優先 | 調達の重点 | 価格感度 |

| 北米 | UL / ETL | 安全性、保証、リードタイム | ミディアム |

| ヨーロッパ | CE / RoHS / ERP | 持続可能性、ESG コンプライアンス | 中高 |

| APAC | さまざまな (CCC、PSE、KC など) | カスタマイズ、迅速な配達 | 高い |

| めー | CE / ローカル規格 | 耐久性、高温耐性 | ミディアム |

結論

この分析は、価格設定構造、サプライ チェーンの違い、技術の進化、アプリケーションの傾向、および競争状況をカバーする COB LED ストリップの世界的な開発を体系的に検討しました。 COB ストリップは、シンプルな照明コンポーネントから、商業用照明、小売ディスプレイ、および新興アプリケーションのアップグレードを推進する重要なソリューションへと進化してきました。

バイヤー、デザイナー、エンジニアにとって、価格設定の背後にある価値を理解し、投資収益率を最も高めるには、最初の購入コストだけでなく、ライフサイクル パフォーマンスに集中することが不可欠です。 同時に、中国の製造業は、完全なサプライ チェーンとますます成熟した品質管理を備えており、グローバル市場の基礎となっています。

有効性、演色性、一貫性、スマートな統合におけるブレークスルーが続く 3 ~ 5 年で、COB LED ストリップは、さまざまなアプリケーションで新たな可能性を切り開くでしょう。 小売店からスマート ホーム、ハイエンドの商業プロジェクトから持続可能な照明ソリューションまで、COB テクノロジーは業界標準を再形成し、グローバルな照明市場で新しい価値を生み出し続けます。