Aangezien de Verenigde Staten extra tarieven op de Chinese export hebben opgelegd, hebben veel LED-strip Fabrikanten hebben een deel van hun productie naar Vietnam verschoven om de landkosten te verlagen en concurrerend te blijven. In 2025 is deze trend meer uitgesproken, waarbij zowel Chinese als Vietnamese faciliteiten een cruciale rol spelen in de wereldwijde toeleveringsketens. Dit rapport biedt een gestructureerde kostenvergelijking tussen productie-LED-strips in China en Vietnam, waarbij belangrijke factoren zoals materialen, arbeid, overhead, logistiek en naleving worden geanalyseerd. Het doel is om kopers en projectmanagers te helpen bij het nemen van weloverwogen sourcing-beslissingen in een veranderende handelsomgeving.

Overhead & Factory Operations

De overhead van de fabriek is een belangrijke bijdrage aan de totale productiekosten. In China vereisen grondverwerving en de bouw van faciliteiten in industriële zones hogere investeringen vooraf, en maandelijkse huurtarieven in kuststeden behoren tot de hoogste in Azië. Vietnam biedt relatief lagere toetredingsbarrières, met kosten voor landgebruik en huurkosten van gemiddeld ongeveer tweederde van de gelijkwaardige faciliteiten in China. De uitgaven voor nutsvoorzieningen volgen een soortgelijk patroon: elektriciteit en watertarieven in Vietnam zijn over het algemeen 20-301 TP3T lager, hoewel af en toe leveringsonderbrekingen de consistentie kunnen beïnvloeden. De afschrijvings- en onderhoudskosten van apparatuur blijven vergelijkbaar, aangezien de meeste productielijnen afhankelijk zijn van geïmporteerde SMT-machines van dezelfde leveranciers. Over het algemeen biedt Vietnam een kostenvoordeel bij overhead en operaties, maar Chinese fabrieken bieden betrouwbaardere infrastructuur en ondersteunende diensten, die een deel van de besparingen in de productie op lange termijn kunnen compenseren.

Labor & Assemblagekosten

Arbeid blijft een van de meest zichtbare kostendifferentiators tussen China en Vietnam. In 2025 varieert het gemiddelde maandelijkse basisloon voor een elektronica-assemblagewerker in China van 600-700 USD in kustprovincies, met overuren en voordelen die de totale maandelijkse kosten dichter bij USD 800-850 brengen. In Vietnam verdienen vergelijkbare werknemers 350-450 dollar per maand, met een aanzienlijk lager overwerkpercentage, wat resulteert in een totale arbeidskosten van ongeveer de helft van die van China.

De productiviteitsverschillen verkleinen deze kloof echter. Chinese werknemers bereiken over het algemeen een hogere doorvoer vanwege meer ervaring in de industrie, gestandaardiseerde processen en een hogere acceptatie van geautomatiseerde SMT-lijnen. Veel Chinese fabrieken draaien met 60-70%-automatisering in LED-stripassemblage, terwijl Vietnamese planten vaak afhankelijk zijn van semi-geautomatiseerde of handmatige processen, wat leidt tot langere cyclustijden en hogere herbewerkingssnelheden.

Concluderend, Vietnam biedt goedkopere arbeid op papier, maar de efficiëntie en automatisering van China verminderen het arbeidskostenvoordeel per eenheid, vooral in projecten met een hoog volume en kwaliteitsgevoelige kwaliteit.

| Factor | China (2025) | Vietnam (2025) | Relatieve impact |

| Basisloon (maandelijks) | USD 600-700 | USD 350-450 | Vietnam ~60% van China |

| Overuren & voordelen | USD 200+ | USD 80-120 | Goedkoper in Vietnam |

| Automatiseringsniveau | 60-70% | 30-40% | China efficiënter |

| Totale arbeidskosten per eenheid | hoger per werknemer, lager per eenheid | Lager per werknemer, hoger per eenheid | Gemengd resultaat |

Materiaal- en componentkosten

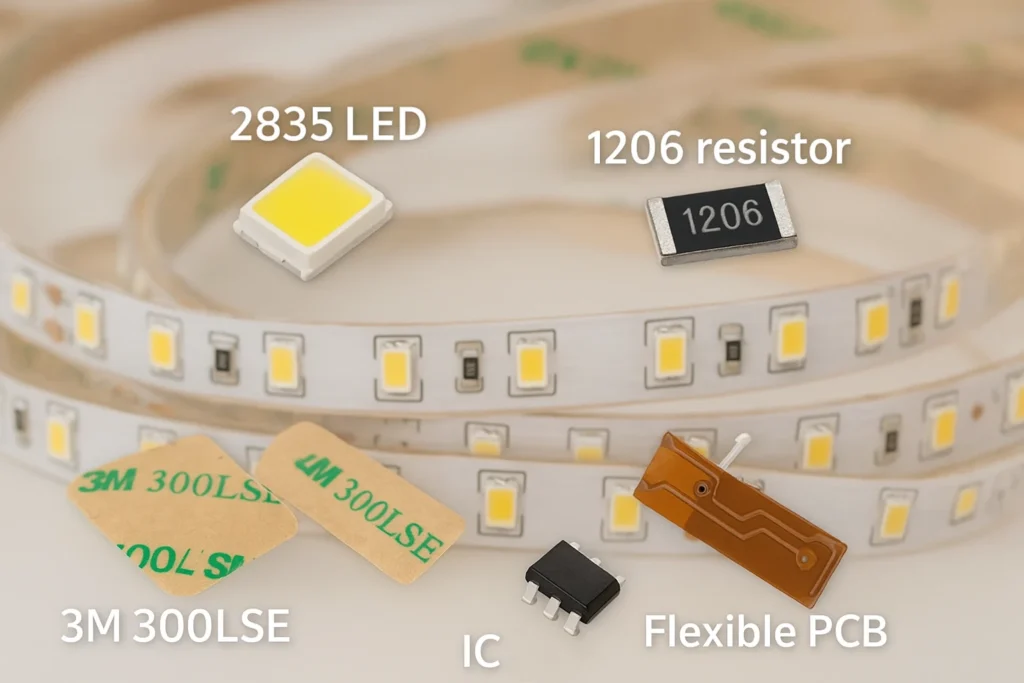

De stuklijst vertegenwoordigt het grootste aandeel van de productiekosten van LED-strips, en hier handhaaft China een duidelijk structureel voordeel. LED-chips, weerstanden, condensatoren en driver-IC's worden meestal in eigen land ingekocht in China, profiterend van concurrerende prijzen en onmiddellijke beschikbaarheid. Flexibele PCB's worden ook op grote schaal geproduceerd in Chinese productiehubs, met schaalvoordelen die de kosten lager houden. Aluminiumprofielen, diffusers en thermische lijmen zijn eveneens overvloedig, ondersteund door een dicht lokaal ecosysteem van extrusie- en chemische leveranciers.

Daarentegen zijn de LED-stripfabrieken van Vietnam sterk afhankelijk van geïmporteerde inputs. Terwijl de productie van lokale PCB's en mechanische onderdelen geleidelijk aan opkomt, worden hoogwaardige LED-diodes, COB-pakketten en slimme besturings-IC's nog steeds vanuit China verzonden. Zelfs essentiële items zoals siliconencoatings en structurele lijmen worden geïmporteerd, wat leidt tot langere doorlooptijden en extra logistieke kosten.

In de praktijk opereren Vietnamese fabrieken voornamelijk als assemblagelocaties. Ze zorgen voor competitieve arbeid en besparingen boven het hoofd, maar het grootste deel van hun materiële basis blijft Chinees, wat de centrale rol van China in de toeleveringsketen van LED-strips onderstreept.

Logistiek & Handelsfactoren

China handhaaft sterke infrastructuurvoordelen, met havens van wereldklasse zoals Shenzhen, Shanghai en Ningbo, die voorspelbare scheepvaartschema's en concurrerende vrachttarieven garanderen. De doorlooptijden voor belastingen met volledige container zijn doorgaans korter vanwege volwassen exportprocedures en dichte carrier-netwerken. De logistieke kosten van Vietnam zijn iets lager voor binnenvaart en havenafhandeling, maar de havens hebben te maken met capaciteitsbeperkingen, wat af en toe vertragingen kan veroorzaken. Voor kleine en middelgrote zendingen blijven de flexibiliteit van China en het gevestigde expediteur-ecosysteem superieur.

Voor de Amerikaanse markt blijven tarieven de sourcingbeslissingen vormgeven. In China gemaakte LED-strips zijn onderworpen aan aanvullende rechten, die de landkosten met 15-251 TP3T kunnen verhogen. Vietnam daarentegen profiteert momenteel van tariefvrijstellingen of lagere rechten onder bestaande handelsovereenkomsten, waardoor het een voorkeursoptie is voor Amerikaanse importeurs. Voor Europa en andere regio's is de tariefdruk minimaal en hebben kopers de neiging om prioriteit te geven aan de betrouwbaarheid van de toeleveringsketen en de productkwaliteit boven de herkomst.

Vietnam biedt Amerikaanse kopers een kostenvoorsprong door middel van tariefhulp, terwijl China wereldwijd concurrerend blijft vanwege efficiëntie, schaal en volwassen logistiek. De optimale keuze hangt grotendeels af van de doelmarkt- en volumevereisten.

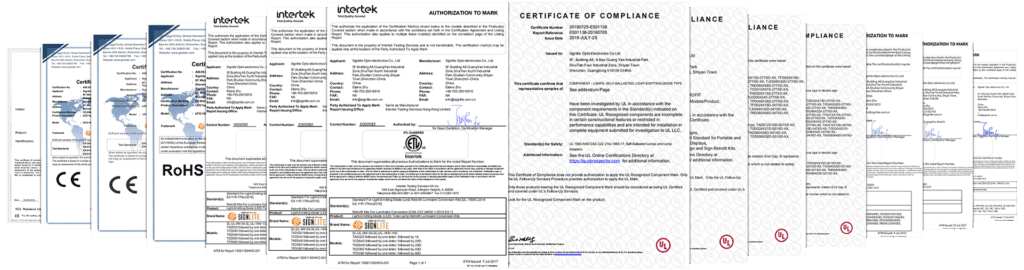

Nalevings- en certificeringskosten

Certificeringskosten zijn een andere factor in de totale kosten. In China, gevestigde laboratoria en lange ervaring met UL-, ETL-, CE- en ROHS-tests, stellen fabrikanten fabrikanten in staat om de nalevingsprocedures snel en tegen lagere tarieven te voltooien, vaak gebundeld met productiediensten. De testinfrastructuur van Vietnam is minder ontwikkeld; veel fabrieken moeten monsters naar het buitenland of naar China sturen voor certificering, wat zowel tijd als kosten toevoegt. Hoewel het directe vergoedingsverschil matig kan zijn, zorgt de efficiëntiekloof ervoor dat China aantrekkelijker blijft voor projecten die snelle certificering en frequente productupdates vereisen.

Totaal gelande kostenscenario's

Kostenconcurrentievermogen verschuift met de ordergrootte. Voor kleine batches rechtvaardigen de hogere kosten van China en hogere arbeid en overhead de kosten van een eenheid, maar de snellere sourcing en lagere defecte tarieven rechtvaardigen vaak de premie. In grotere volumes creëren de arbeidsbesparingen en tariefvoordelen van Vietnam voor Amerikaanse kopers een betekenisvolle kloof, hoewel het vertrouwen op geïmporteerd materiaal het verschil verkleint.

| draaiboek | China (2025) | Vietnam (2025) | Belangrijkste afhaalmaaltijden |

| Kleine partij (≤500 eenheden) | Hogere eenheidskosten, snellere doorlooptijd | Lagere arbeidskosten, langere inkooplead | China sterker voor prototypes, dringende bestellingen |

| Grote partij (≥5.000 eenheden) | Schaalvoordelen, stabiele kwaliteit | Arbeidsbesparing + tariefaftrek in de VS | Vietnam concurrerend voor Amerikaanse markt |

Conclusie

China en Vietnam bieden elk kostenvoordelen, maar de beste inkoopkeuze hangt af van de marktbestemming en de projectschaal. Vietnam biedt tariefhulp voor Amerikaanse kopers en concurrerende arbeidskosten, terwijl China ongeëvenaarde sterke punten in materiaal, automatisering, certificering en betrouwbare logistiek behoudt. te SignliteLED, onze Chinese faciliteiten leveren een hoge efficiëntie, volledige interne sourcing van componenten en bewezen kwaliteitssystemen die in de loop van de tijd verborgen kosten verminderen. Voor projecten die een snelle doorlooptijd, strikte naleving en consistente levering vereisen, blijft China een betrouwbare optie. Neem vandaag nog contact op met Signlitetled om uw LED-stripvereisten te bespreken en een kostenanalyse op maat te ontvangen.