Como os Estados Unidos impõem tarifas adicionais às exportações chinesas, muitos fita LED Os fabricantes mudaram parte de sua produção para o Vietnã para reduzir os custos com os terrenos e permanecerem competitivos. Em 2025, essa tendência tornou-se mais pronunciada, com instalações chinesas e vietnamitas desempenhando papéis cruciais nas cadeias de suprimentos globais. Este relatório fornece uma comparação de custos estruturados entre as tiras de LED de fabricação na China e o Vietnã, analisando fatores-chave, como materiais, mão de obra, despesas gerais, logística e conformidade. O objetivo é ajudar compradores e gerentes de projeto a tomarem decisões informadas sobre o fornecimento em um ambiente comercial em mudança.

Operações de fábrica e despesas gerais

A sobrecarga de fábrica contribui significativamente para o custo geral de fabricação. Na China, a aquisição de terrenos e a construção de instalações em zonas industriais exigem um investimento inicial mais alto, e as taxas de aluguel mensal nas cidades costeiras estão entre as mais altas da Ásia. O Vietnã oferece barreiras de entrada comparativamente mais baixas, com custos de uso da terra e despesas de aluguel em média de dois terços das instalações equivalentes na China. As despesas com serviços públicos seguem um padrão semelhante: as tarifas de eletricidade e água no Vietnã geralmente são 20–30% menores, embora interrupções ocasionais no fornecimento possam afetar a consistência. Os custos de depreciação e manutenção do equipamento permanecem semelhantes, pois a maioria das linhas de produção depende de máquinas SMT importadas dos mesmos fornecedores. No geral, o Vietnã oferece uma vantagem de custo em despesas gerais e operações, mas as fábricas chinesas oferecem infraestrutura e serviços de suporte mais confiáveis, o que pode compensar parte da economia na produção de longo prazo.

Custos de mão de obra e montagem

A mão de obra continua sendo um dos diferenciadores de custos mais visíveis entre a China e o Vietnã. Em 2025, o salário base médio mensal de um trabalhador da montagem de eletrônicos na China varia de US$ 600 a 700 nas províncias costeiras, com horas extras e benefícios aproximando o custo mensal total de US$ 800 a 850. No Vietnã, trabalhadores comparáveis ganham US$ 350 a 450 por mês, com taxas de horas extras significativamente mais baixas, resultando em um custo total de mão de obra de cerca de metade da China.

No entanto, as diferenças de produtividade reduzem essa lacuna. Os trabalhadores chineses geralmente obtêm maior rendimento devido à maior experiência do setor, processos padronizados e maior adoção de linhas SMT automatizadas. Muitas fábricas chinesas funcionam com automação 60–70% em conjunto de tiras de LED, enquanto as plantas vietnamitas geralmente dependem de processos semiautomáticos ou manuais, levando a tempos de ciclo mais longos e taxas de retrabalho mais altas.

Em conclusão, o Vietnã oferece mão de obra mais barata no papel, mas a eficiência e a automação da China reduzem a vantagem de custo de mão de obra por unidade, especialmente em projetos de alto volume e sensíveis à qualidade.

| Fator | China (2025) | Vietnã (2025) | impacto relativo |

| Salário base (mensal) | USD 600–700 | USD 350–450 | Vietnã ~60% da China |

| Horas extras e benefícios | US$ 200+ | USD 80–120 | Mais barato no Vietnã |

| Nível de automação | 60–70% | 30–40% | China mais eficiente |

| Custo total da unidade de mão de obra | Maior por trabalhador, menor por unidade | Menor por trabalhador, maior por unidade | Resultado misto |

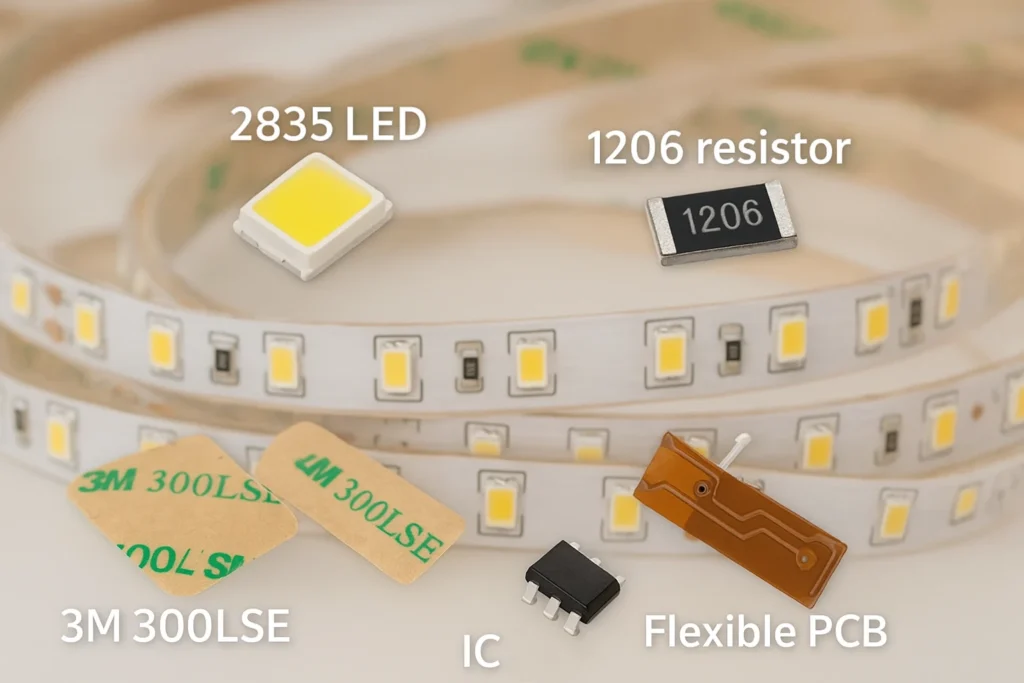

Custos de materiais e componentes

A lista de materiais representa a maior parcela dos custos de produção de tiras de LED, e aqui a China mantém uma vantagem estrutural clara. Chips de LED, resistores, capacitores e CIs de driver são principalmente adquiridos no mercado interno na China, beneficiando de preços competitivos e disponibilidade imediata. Os PCBs flexíveis também são amplamente produzidos em hubs de manufatura chineses, com economias de escala que mantêm os custos mais baixos. Os perfis de alumínio, difusores e adesivos térmicos são igualmente abundantes, apoiados por um denso ecossistema local de fornecedores de produtos químicos e extrusão.

Por outro lado, as fábricas de LEDs do Vietnã dependem muito de insumos importados. Enquanto a produção local de PCB e peças mecânicas está surgindo gradualmente, diodos LED de alta qualidade, pacotes de COB e CIs de controle inteligente ainda são enviados da China. Até mesmo itens essenciais, como revestimentos de silicone e adesivos estruturais, são importados, levando a prazos de entrega mais longos e custos adicionais de logística.

Em termos práticos, as fábricas vietnamitas operam principalmente como locais de montagem. Eles fornecem economia de mão de obra competitiva e custos gerais, mas a maior parte de sua base de materiais continua sendo chinesa, ressaltando o papel central da China na cadeia de suprimentos de LEDs.

Fatores de logística e comércio

A China mantém fortes vantagens de infraestrutura, com portos de classe mundial, como Shenzhen, Xangai e Ningbo, garantindo horários de remessa previsíveis e taxas de frete competitivas. Os prazos de entrega para cargas de contêiner completos geralmente são mais curtos devido aos procedimentos de exportação maduros e redes de densas operadoras. Os custos de logística do Vietnã são ligeiramente mais baixos para transporte interno e manuseio portuário, mas suas portas enfrentam restrições de capacidade, o que ocasionalmente pode causar atrasos. Para remessas pequenas e médias, a flexibilidade da China e o ecossistema de transitários estabelecidos permanecem superiores.

Para o mercado dos EUA, as tarifas continuam a moldar as decisões de fornecimento. As faixas de LED fabricadas na China estão sujeitas a taxas adicionais, o que pode aumentar os custos de desembarque em 15–25%. O Vietnã, por outro lado, atualmente se beneficia de isenções tarifárias ou taxas mais baixas sob os acordos comerciais existentes, tornando-se uma opção preferida para os importadores americanos. Para a Europa e outras regiões, a pressão tarifária é mínima e os compradores tendem a priorizar a confiabilidade da cadeia de suprimentos e a qualidade do produto em relação à origem.

O Vietnã oferece aos compradores dos EUA uma vantagem de custo por meio de um alívio tarifário, enquanto a China permanece competitiva globalmente devido à eficiência, escala e logística madura. A escolha ideal depende em grande parte dos requisitos do mercado-alvo e volume.

Custos de conformidade e certificação

As despesas de certificação são outro fator de custo total. Na China, laboratórios estabelecidos e longa experiência com testes UL, ETL, CE e RoHS permitem que os fabricantes concluam os procedimentos de conformidade rapidamente e com taxas mais baixas, geralmente em conjunto com serviços de produção. A infraestrutura de testes do Vietnã é menos desenvolvida; muitas fábricas devem enviar amostras para o exterior ou para a China para certificação, adicionando tempo e custo. Embora a diferença direta de taxas possa ser moderada, a diferença de eficiência significa que a China continua mais atraente para projetos que exigem certificação rápida e atualizações frequentes de produtos.

Cenários de custo total de desembarque

A competitividade dos custos muda com o tamanho do pedido. Para pequenos lotes, a unidade de mão de obra mais alta e de empurrão da China custa ascendente, mas seu fornecimento mais rápido e taxas de defeitos mais baixas geralmente justificam o prêmio. Em volumes maiores, as vantagens tarifárias e de economia de mão de obra do Vietnã para os compradores dos EUA criam uma lacuna significativa, embora a dependência de materiais importados dificulte a diferença.

| cenário | China (2025) | Vietnã (2025) | Dica de chave |

| Lote pequeno (≤ 500 unidades) | Custo unitário mais alto e mais rápido | Menor custo de mão de obra, mais tempo de abastecimento | China mais forte para protótipos, pedidos urgentes |

| Lote grande (≥5.000 unidades) | Economias de escala, qualidade estável | Economia de mão de obra + Alívio das tarifas dos EUA | Vietname competitivo para o mercado dos EUA |

Conclusão

Cada um oferece vantagens de custo, mas a melhor opção de sourcing depende do destino do mercado e da escala do projeto. O Vietnã oferece alívio tarifário para os compradores dos EUA e custos de mão de obra competitiva, enquanto a China mantém forças incomparáveis em materiais, automação, certificação e logística confiável. a SignliteLED, nossas instalações chinesas oferecem alta eficiência, sourcing interno de componentes completos e sistemas comprovados de qualidade que reduzem os custos ocultos ao longo do tempo. Para projetos que exigem recuperação rápida, conformidade estrita e fornecimento consistente, a China continua sendo uma opção confiável. Entre em contato com a Signlited hoje para discutir os requisitos da tira de LED e receber uma análise de custos personalizada.