Em 2025, os Estados Unidos continuam a remodelar o comércio global por meio de uma série de tarifas novas e estendidas. Desde as tarifas renovadas sobre as importações chinesas até o aumento do escrutínio de mercadorias direcionadas ao Sudeste Asiático, os importadores enfrentam custos crescentes e riscos de conformidade. Enquanto isso, novas funções sobre aço e alumínio, juntamente com políticas em evolução para o Canadá e o México sob o USMCA, complicam ainda mais as decisões de abastecimento. Este artigo fornece uma visão clara do cenário das tarifas mais recentes dos EUA e do que os importadores precisam saber para se manterem competitivos e compatíveis.

Por que as tarifas são importantes em 2025

Em abril de 2025, os EUA anunciaram uma nova onda de aumentos de tarifas, expandindo as funções de uma ampla gama de importações de países como China, México e Canadá. Essas ações – enquadradas como esforços para proteger as indústrias domésticas e reduzir a dependência de concorrentes estratégicos – enviaram efeitos de cascata no comércio global.

Para a China, as tarifas renovadas visam setores-chave, como veículos elétricos, baterias e aço, reforçando a dissociação contínua das cadeias de suprimentos. Canadá e México, embora protegidos pelo USMCA, enfrentaram novas disputas e uma aplicação mais rigorosa das regras de origem, especialmente nos setores de aço e automotivo.

No mercado interno, o impacto é duplo: os fabricantes dos EUA que dependem de componentes importados estão enfrentando custos de insumos mais altos, enquanto importadores e consumidores já estão experimentando preços em alta entre produtos, desde eletrônicos até materiais de construção. Essa pressão pode pesar sobre a inflação e a recuperação econômica.

Compreender o escopo e a lógica por trás dessas tarifas é essencial – não apenas para grandes corporações, mas também para pequenas e médias empresas que estão navegando em todo o fornecimento global. Esteja você importando matérias-primas, produtos acabados ou peças, o cenário tarifário em 2025 pode influenciar diretamente seus resultados, competitividade e riscos de conformidade.

2025 EUA-China Escalação e retaliação das tarifas: cronograma, razões e impacto

1. O cronograma de escalação de tarifas dos EUA

Ao longo de 2025, os EUA implementaram várias rodadas de aumentos de tarifas nas importações chinesas, citando razões que vão desde a crise do fentanil até desequilíbrios comerciais e apelos por tarifas globais “recíprocas”. Aqui está uma análise:

| período | aumento tarifário | razão | Tarifa total | Cobertura |

| 1 de fevereiro de 25 | 10% | Problema de fentanil, déficit comercial | 10% | todos os produtos chineses |

| 4-Mar-25 | 10% | Escalonamento do problema do fentanil | 20% | todos os produtos chineses |

| 2 de abril a 25 | 34% | Política global de "tarifários recíprocos" | 54% (20% + 34%) | todos os produtos chineses |

| 9 de abril a 25 | 50% | China não retirou contra-medidas | 104% (20%+34%+50%) | todos os produtos chineses |

| 10 de abril-25 | 41% | Pressão adicional em Pequim | 145% total | todos os produtos chineses |

2. O cronograma de contra-tarifárias da China

A China respondeu com seu próprio conjunto de tarifas de retaliação voltadas para as exportações dos EUA, principalmente para a energia e para a agricultura:

| período | tarifa | Produtos de destino | razão |

| 4 de fevereiro de 25 | 10%–15% | Carvão, GNL (15%), petróleo bruto, máquinas agrícolas, caminhões (10%) | Resposta às tarifas de 1º de fevereiro |

| 4-Mar-25 | 10%–15% | Frango, trigo, milho, algodão (15%), soja, carne, leite (10%) | Resposta à escalada dos EUA em 4 de março |

| 4 de abril a 25 | 34% | Todos os produtos dos EUA | Resposta às tarifas “recíprocas” dos EUA |

| 9 de abril a 25 | +50% (total 84%) | Todos os produtos dos EUA | Retaliação das tarifas de 9 de abril |

| 10 de abril-25 | +41% (total 125%) | Todos os produtos dos EUA | Retaliação para escalação de 10 de abril |

3. Descalonamento em maio de 2025

Em uma mudança notável, May marcou um ponto de virada nas tensões comerciais entre EUA e China:

10 de maio de 2025: negociações comerciais de alto nível começaram entre Washington e Pequim.

12 de maio de 2025: Uma declaração conjunta anunciou uma redução do 91% nas tarifas de retaliação e a suspensão de 24% das tarifas “recíprocas” impostas anteriormente.

13 de maio de 2025: a China confirmou “progresso substancial”. Os EUA mantiveram uma tarifa 10% básica, removendo todas as camadas adicionais das escalações de abril.

Gráfico de cronograma de tarifas (2025)

| período | Tarifa dos EUA | contra-tarifa da China | notas |

| 1 de fevereiro | 10% | 4 de fevereiro: 10–15% | Fentanil e déficit comercial |

| 4-Mar | 20% | 4 de março: 10–15% | escalada |

| 2 de abril | 54% | 4 de abril: 34% | Tarifas “recíprocas” |

| 9 de abril | 104% | 9 de abril: 84% | Sem retirada pela China |

| 10 de abril | 145% | 10 de abril: 125% | Pico da guerra tarifária |

| 12 de maio | 30% (somente na linha de base) | 10% (apenas a linha de base permanece) | Redução do 91% após negociações bem-sucedidas |

Tarifas dos EUA sobre os países do Sudeste Asiático

À medida que os EUA reforçam a política comercial em 2025, países do Sudeste Asiático, como Vietnã, Tailândia, Malásia e Indonésia, passaram por um maior escrutínio. Embora essas nações tenham se beneficiado nos anos anteriores com os fabricantes que se mudaram da China, essa mudança agora está enfrentando ventos contrários, à medida que os EUA reprimem as práticas de transbordo e implementam novas tarifas específicas do setor.

1. Repressão ao Transbordo

Para conter os esforços dos exportadores chineses para contornar as altas tarifas, a Alfândega e Proteção de Fronteiras dos EUA (CBP) lançou investigações sobre fraudes de origem - onde os produtos chineses são rotulados no Sudeste Asiático antes de serem enviados para os EUA.

Vietnã e Malásia têm sido os principais alvos de investigação.

As autoridades dos EUA estão exigindo uma prova substancial de transformação substancial para produtos exportados do Sudeste Asiático.

Os importadores que não possuem documentação clara podem enfrentar taxas retroativas, penalidades ou apreensão de mercadorias.

2. Novas tarifas sobre os principais produtos

Embora as tarifas amplas como as da China ainda não estejam em vigor para os países do Sudeste Asiático, as funções direcionadas foram impostas a categorias específicas de produtos relacionadas ao excesso de capacidade chinesa ou preocupações com a segurança nacional:

| país | produto afetado | Tarifa (2025) | razão |

| Vietnã | Painéis solares, baterias | 15–25% | Componentes supostos da origem chinesa |

| Malásia | extrusões de alumínio | 18% (Trabalho Anti-dumping) | Vinculado ao transbordo da China |

| Tailândia | Produtos de borracha, tubos de aço | 10–15% | Sobrecapacidade, subsídios industriais |

| Indonésia | certos componentes eletrônicos | 12% | Segurança Nacional, Rastreabilidade |

3. Estratégia dos EUA: acautelação de amigos com cautela

O governo Biden continua promovendo o “shoring de amigos” – incentivando as mudanças na cadeia de suprimentos para parceiros confiáveis – mas 2025 mostra uma abordagem mais sutil:

O Sudeste Asiático ainda é visto como um centro de manufatura, mas não imune à fiscalização dos EUA.

As tarifas futuras podem segmentar a origem do produto em vez de o país, tornando a conformidade e a documentação mais críticas do que nunca.

Os compradores e importadores dos EUA estão sendo aconselhados a realizar auditorias de fornecedores, rastrear a origem do componente e revisar as certificações FTA.

Tarifas sobre mercadorias do Sudeste Asiático originalmente fabricadas na China

Em 2025, o governo dos EUA intensificou a aplicação de mercadorias transbordas – produtos originalmente fabricados na China, mas encaminharam os países do Sudeste Asiático para evitar altas tarifas. Essa prática, considerada uma forma de evasão tarifária, agora está sendo alvo agressivamente pela Alfândega e Proteção de Fronteiras dos EUA (CBP) e pelo Departamento de Comércio.

1. Políticas-chave e tendências de fiscalização

Verificação do país de origem: Os EUA exigem que os importadores forneçam evidências de que as mercadorias passaram por uma transformação substancial no país terceiro (por exemplo, Vietnã, Malásia) para se qualificarem como não-chineses.

Seção 301 Rastreamento de tarifas: produtos suspeitos de serem de origem chinesa – mesmo que rotulados ou montados no Sudeste Asiático – ainda podem estar sujeitos a até 145% nos atuais cronogramas tarifários da China.

Taxas retroativas e apreensões: os importadores pegos violando as regras de origem enfrentam direitos retroativos, multas financeiras ou até mesmo remessa de remessas nos portos dos EUA.

Escrutínio FTA: Mercadorias que reivindicam o status isento de impostos sob as regras comerciais preferenciais dos EUA-Vietnã ou EUA-ASEAN estão agora sujeitas a requisitos aprimorados de auditoria e documentação.

2. Impacto nas cadeias de suprimentos globais

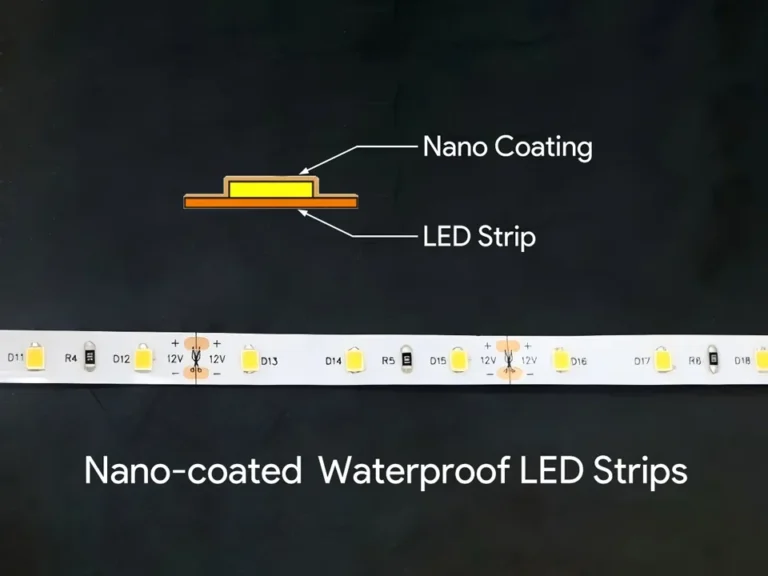

Os fabricantes do Sudeste Asiático que contam com matérias-primas ou componentes chineses (por exemplo, alumínio, PCBs, chips LED) agora são obrigados a divulgar os processos de origem e transformação

Os importadores dos EUA estão sob pressão para auditar fornecedores e revisar as pegadas de produção para mitigar os riscos legais e financeiros.

Produtos sem rastreabilidade clara podem perder benefícios tarifários, mesmo se terminarem nos países da ASEAN.

3. Exemplo de caso: luzes de tiras de LED

As luzes de tiras de LED são um excelente exemplo de como esse problema afeta o comércio do mundo real.

Prática comum: muitas luzes LED Strip são montadas no Vietnã ou na Tailândia, mas usam chips LED de origem chinesa, perfis de alumínio e PCBs.

Posição Aduaneira dos EUA (2025): Se os componentes são meramente montados e não transformados substancialmente (ou seja, nenhuma mudança significativa na forma, função ou valor), o produto ainda é tratado como “Made in China” e sujeito à tarifa completa da Seção 301 – até 145%.

Estratégia de conformidade:

Os importadores dos EUA devem solicitar listas de materiais (BOM), fluxogramas de fabricação e certificados de origem.

Os fornecedores precisam demonstrar que o processo de produção no Sudeste Asiático muda o caráter essencial do produto.

Alguns importadores estão mudando para uma produção totalmente localizada na ASEAN ou no México para reduzir o risco.

Principais conclusões para importadores

Sempre verifique a origem do componente e a profundidade de processamento no país terceiro.

Não confie apenas em etiquetas ou faturas — o CBP exige a prova de fabricação.

Para categorias de produtos sensíveis, como iluminação LED, módulos solares, eletrônicos, a conformidade proativa agora é essencial.

Como evitar riscos tarifários em 2025 – dicas estratégicas para importadores

Com as políticas tarifárias dos EUA se tornando mais complexas e agressivas em 2025, os importadores enfrentam um novo conjunto de riscos, não apenas nas taxas de impostos, mas na documentação, conformidade e rastreabilidade da cadeia de suprimentos. Para se manter competitivo e minimizar a exposição financeira, é fundamental trabalhar com os fornecedores certos e adotar uma abordagem estratégica de compras.

Aqui estão as estratégias chave para os importadores dos EUA reduzirem os riscos relacionados às tarifas, mantendo a qualidade, o prazo de entrega e a eficiência de custos:

1. Escolha fornecedores que possam oferecer flexibilidade e valor

Nem todos os fornecedores chineses são iguais. O parceiro certo pode ajudá-lo a absorver um pouco do impacto das tarifas:

Disposição para compartilhar custos: os fornecedores de primeira linha podem oferecer ajustes de preços, compartilhamento de custos com tarifas ou reestruturar os preços para manter o custo do seu terreno.

Condições de pagamento flexíveis: negociar termos de pagamento (por exemplo, pagamento parcial após a entrega, LC ou OA) ajuda a gerenciar seu fluxo de caixa em um ambiente de alta função.

Políticas de câmbio estáveis: fornecedores que fazem hedge de moeda ou oferecem preços em USD podem protegê-lo contra oscilações de RMB.

2. Priorize fornecedores com forte capacidade e entrega rápida

Em um ambiente global volátil, o lead time é dinheiro. Fornecedores que podem acelerar os prazos de produção e entrega oferecem uma vantagem real:

Retorno mais curto = menos risco de estoque: a produção rápida ajuda a reduzir os custos de armazenamento e evita atrasos durante o despacho alfandegário ou mudanças nas políticas.

Plantas de alta capacidade: evite fábricas com overbooking ou sazonais que não podem escalar rapidamente – especialmente importantes durante as janelas tarifárias ou disputas comerciais.

Manufatura interna: fornecedores com instalações próprias (em vez de terceirizar tudo) tendem a ser mais confiáveis e melhores no controle de qualidade.

3. Garanta a qualidade e otimiza o preço

Custo de corte não deve significar cortes de canto. A alfândega dos EUA agora examina a documentação e a qualidade mais do que nunca:

Registros completos de CQ: escolha fornecedores que possam fornecer relatórios completos de inspeção, certificações de materiais e arquivos de conformidade.

Cadeia de suprimentos integrada: fornecedores que controlam sua própria listagem (por exemplo, PCB, perfil de alumínio, chip LED) estão melhor equipados para garantir uma qualidade consistente e reduzir os custos dos componentes.

Capacidade de teste: procure parceiros com testes de envelhecimento, relatórios do IES e validação de terceiros, se necessário, especialmente para produtos como iluminação LED.

4. Avaliar a capacidade de diversificação de risco do Sudeste Asiático

Para reduzir a dependência de mercadorias de origem chinesa, pergunte se o seu fornecedor possui operações ou parcerias no Sudeste Asiático:

Plantas do Vietnã, da Malásia ou da Tailândia: esses locais podem ajudar a reduzir a exposição ao serviço – se os produtos passarem por uma transformação real.

Recursos de OEM no exterior: alguns fabricantes chineses operam instalações compatíveis no exterior. Essa configuração pode ajudá-lo a manter a eficiência das tarifas enquanto trabalha com um fornecedor conhecido.

Verifique a conformidade: sempre se certifique de que esses bens no exterior possam ser uma transformação de origem para evitar as penalidades de transbordo nos EUA.

5. Otimize a estratégia de frete para custos e velocidades

O envio desempenha um papel importante no custo do seu terreno. Um plano de logística inteligente pode ajudá-lo a economizar, mesmo em um ambiente de alta tarifa:

Envio consolidado: use cargas de contêiner completo (FCL) ou consolidação de hub para reduzir os custos por unidade.

Armazenamento próximo ao porto: reduz o tempo de entrega doméstico e permite uma resposta alfandegária mais rápida.

Estratégia de porta dupla: evite portas congestionadas ou sob forte escrutínio distribuindo cargas em vários pontos de entrada.

Resumo para compradores dos EUA em 2025

| Área de foco | Consideração-chave |

| Seleção de fornecedores | Flexibilidade em preços, condições de pagamento, QC comprovado |

| capacidade de produção | Pode escalar rapidamente, compactar lead times, fluxo de trabalho estável |

| Qualidade do produto | Componentes prontos para documentação, testados e rastreáveis |

| Opções do Sudeste As | disponível e complacente fabricação de um país terceiro |

| Otimização logística | Menor custo por unidade via frete mais inteligente + liberação mais rápida |

Ao repensar os relacionamentos com fornecedores e otimizar suas decisões upstream, os importadores podem manter as margens de lucro, evitar penalidades e permanecer competitivos, mesmo diante dos riscos crescentes de tarifas.

Como a Signlite ajuda a reduzir o impacto das tarifas para nossos clientes

Na Signlite, entendemos como o aumento das tarifas dos EUA criou incerteza e pressão de custos para nossos parceiros globais. Como fabricante líder na indústria de luz LED Strip, temos o compromisso de ajudar nossos clientes a reduzir seus riscos e proteger suas margens, mesmo em um ambiente comercial volátil.

1. Forte alavancagem de fornecedores para controlar custos

Graças ao nosso grande volume de exportações e relacionamentos de longa data com os principais fornecedores de matérias-primas, a Signlite possui um poder de compra significativo. Isso nos permite:

Negocie melhores preços em LEDs, PCBs, perfis de alumínio e drivers.

Absorver parte do aumento do custo das tarifas para aliviar a carga de nossos clientes.

Forneça citações mais estáveis e previsíveis durante períodos incertos.

Não passamos simplesmente os custos pela cadeia de suprimentos – trabalhamos como parceiros, encontrando soluções ganha-ganha.

2. Qualidade confiável, sempre primeiro

As questões tarifárias podem ir e vir, mas a qualidade do produto nunca deve ser comprometida. em Signlite:

Cada tira de LED é testada e envelhecida antes do envio.

Mantemos a rastreabilidade total com registros de QC, relatórios de teste IES e documentação de BOM.

Ajudamos os clientes a evitar retenções aduaneiras e rejeições de produtos, economizando muito mais do que apenas taxas de tarifas.

A confiança é construída com base na consistência e levamos essa responsabilidade a sério.

3. Alta capacidade de produção para aproveitar as janelas de tempo

Com nossas linhas de produção avançadas e equipes qualificadas, o Signlite pode ser escalado rapidamente quando surgem oportunidades, especialmente durante as janelas de suspensão tarifária.

Somos capazes de trabalhar horas extras para atender pedidos urgentes.

O agendamento flexível nos permite priorizar os envios sensíveis ao tempo.

Os clientes ganham uma vantagem crítica ao enviar produtos antes que novas funções tenham efeito.

Essa capacidade de “mover-se rápido” ajudou muitos parceiros a minimizar custos inesperados.

4. Apoio à logística estratégica para melhores taxas de envio

Em 2025, o espaço de transporte limitado e o congestionamento portuário são preocupações reais. A equipe de logística da Signlite tem conexões profundas com transportadores e transportadores de carga, permitindo-nos:

Garanta espaço com taxas competitivas, mesmo durante as temporadas de pico.

Ofereça opções de envio com várias portas para reduzir o risco e o prazo de entrega.

Coordenar o carregamento total do contêiner (FCL) ou a consolidação do LCL para otimizar o custo por unidade.

Não apenas fabricamos — oferecemos tranquilidade.

Faça parceria com um fornecedor confiável em tempos de incerteza

Na Signlite, fazemos mais do que fazer Tiras de LED. Ajudamos nossos clientes a navegar com confiança em ambientes de comércio global complexos. Do suporte a preços à rápida produção e coordenação logística, estamos comprometidos em ser um parceiro de longo prazo, não apenas um fornecedor de produtos.

Vamos ajudá-lo a minimizar o risco tarifário e maximizar o valor.

Entre em contato com nossa equipe hoje para discutir seu projeto, obter um orçamento gratuito ou solicitar um catálogo de produtos prontos para conformidade.

Notícias tarifárias recentes: medidas dos EUA no Canadá, México e metais

Em meados de 2025, o governo dos EUA continuou expandindo seu alcance tarifário além da China, com novas funções afetando parceiros norte-americanos e materiais industriais importantes.

Cronograma das ações recentes das tarifas:

8 de abril de 2025

Os EUA impõem tarifas 10% sobre produtos de alumínio canadenses selecionados, citando preocupações de segurança nacional de acordo com a seção 232.

Produtos afetados: alumínio semi-acabado, perfis de extrusão.

12 de abril de 2025

Nova tarifa 15% sobre produtos de aço mexicanos anunciada devido a preocupações com o transbordo de metais de origem chinesa no México.

Auditorias especiais lançadas para rastrear a conformidade com a origem.

15 de abril de 2025

Os EUA expandem as tarifas da Seção 232 sobre aço e alumínio globais, adicionando 25% em aço laminado a frio e 15% em produtos de chapa de alumínio de vários países, incluindo Vietnã e Índia.

1 de maio de 2025

Canadá e México protestam em conjunto contra as decisões tarifárias dos EUA na OMC, chamando-as injustificadas e inconsistentes com os compromissos da USMCA.

Essas mudanças recentes sinalizam que os EUA estão adotando uma posição mais agressiva sobre a fiscalização do comércio em países amigáveis e adversários. Os importadores devem monitorar as atualizações de perto e ajustar as estratégias de sourcing de acordo.