В 2025 году Соединенные Штаты продолжают перестраивать мировую торговлю с помощью ряда новых и расширенных тарифов. От возобновления тарифов на китайский импорт до усиления проверки товаров, проходящих через Юго-Восточную Азию, импортеры сталкиваются с ростом затрат и соблюдением рисков. Между тем, новые пошлины на сталь и алюминий, а также развитие политики в отношении Канады и Мексики в рамках USMCA еще больше усложняют решения по поиску источников. В этой статье представлен четкий обзор последних тарифных сфер США и того, что нужно знать импортерам, чтобы оставаться конкурентоспособными и соблюдать.

Почему тарифы имеют значение в 2025 году

В апреле 2025 года США объявили о новой волне повышения тарифов, расширяя пошлины на широкий спектр импорта из таких стран, как Китай, Мексика и Канада. Эти действия, разработанные как усилия по защите отечественных отраслей и снижение зависимости от стратегических конкурентов, вызвали волновой эффект в мировой торговле.

Для Китая возобновленные тарифы нацелены на ключевые сектора, такие как электромобили, батареи и стальные, усиливая продолжающееся разделение цепочек поставок. Канада и Мексика, хотя и находятся под охраной USMCA, столкнулись с новыми спорами и ужесточением соблюдения правил происхождения, особенно в сталелитейном и автомобильном секторах.

Внутри влияние двоякое: американские производители, полагающиеся на импортные компоненты, сталкиваются с более высокими затратами на ввод, в то время как импортеры и потребители уже сталкиваются с ростом цен на товары, начиная от электроники и заканчивая строительными материалами. Это давление могло бы повлиять на инфляцию и восстановление экономики.

Понимание масштабов и логики этих тарифов имеет важное значение — не только для крупных корпораций, но и для малого и среднего бизнеса, занимающегося глобальными источниками. Независимо от того, импортируете ли вы сырье, готовые товары или детали, тарифный ландшафт в 2025 году может напрямую влиять на ваши итоговые риски, конкурентоспособность и соответствие рискам.

2025 г. США и Китай: эскалация и возмездие тарифов США: сроки, причины и влияние

1. Срок эскалации тарифов США

В течение 2025 года США ввели несколько раундов повышения тарифов на китайский импорт, сославшись на причины, начиная от кризиса фентанила до торговых дисбалансов и призывов к «реципрокным» глобальным тарифам. Вот разбивка:

| дата | Увеличение тарифа | сообразова | Общая тарифная ставка | Покрытие |

| 1-25 февраля | 10% | Фентанил, торговый дефицит | 10% | Все китайские товары |

| 4 марта 25 | 10% | Эскалация проблемы с фентанилом | 20% | Все китайские товары |

| 2-25 апр-25 | 34% | Глобальная политика «взаимных тарифов» | 54% (20% + 34%) | Все китайские товары |

| 9-25 апр-25 | 50% | Китай не снимает контрмер | 104% (20%+34%+50%) | Все китайские товары |

| 10-25 апр-25 | 41% | Дальнейшее давление на Пекин | 145% Всего | Все китайские товары |

2. Временная шкала контртарифа Китая

Китай ответил собственным набором ответных тарифов, направленных на экспорт США, в частности в энергетику и сельское хозяйство:

| дата | тарифная ставка | Целевые продукты | сообразова |

| 4 февраля-25 | 10%–15% | Уголь, СПГ (15%), сырая нефть, сельхозтехника, грузовики (10%) | Ответ на тарифы США 1 февраля |

| 4 марта 25 | 10%–15% | Курица, пшеница, кукуруза, хлопок (15%), соевые бобы, мясо, молочные продукты (10%) | Ответ на эскалацию 4 марта в США |

| 4 апреля 25 г. | 34% | Все товары США | Ответ на «Взаимные» тарифы США |

| 9-25 апр-25 | +50% (всего 84%) | Все товары США | Возмездие за тарифы 9 апреля |

| 10-25 апр-25 | +41% (всего 125%) | Все товары США | Возмездие за эскалацию 10 апреля |

3. Деэскалация в мае 2025 г.

В заметный сдвиг, Мэй ознаменовала поворотный момент в торговом напряжении США и Китая:

10 мая 2025 г.: между Вашингтоном и Пекином начались торговые переговоры на высоком уровне.

12 мая 2025 г. В совместном заявлении было объявлено о снижении 91% в ответных тарифах и о приостановке введенных ранее «реципрокных» тарифов 24%.

13 мая 2025 года: Китай подтвердил «существенный прогресс». США поддерживали базовый тариф 10%, удалив все дополнительные уровни из апрельских эскалаций.

Тарифная графика графика (2025)

| дата | Тарифная ставка США | Китайский контртариф | банкноты |

| 1 февраля | 10% | 4 февраля: 10–15% | Фентанил и торговый дефицит |

| 4 марта | 20% | 4 марта: 10–15% | обострение |

| 2 апреля | 54% | 4 апреля: 34% | «Взаимные» тарифы |

| 9 апреля | 104% | 9 апреля: 84% | Нет вывода Китая |

| 10 апреля | 145% | 10 апреля: 125% | Пик тарифной войны |

| 12 мая | 30% (только базовый) | 10% (остается только базовый) | Сокращение 91% после успешных переговоров |

Тарифы США по странам Юго-Восточной Азии

Поскольку США ужесточают торговую политику в 2025 году, такие страны Юго-Восточной Азии, как Вьетнам, Таиланд, Малайзия и Индонезия, находятся под пристальным вниманием. В то время как в предыдущие годы эти страны выиграли от переезда производителей из Китая, эта смена теперь сталкивается с встречными ветром, поскольку США расправляются с практикой перевалки и применяют новые тарифы для конкретных секторов.

1. Репрессия перевалки

Чтобы ограничить усилия китайских экспортеров по обходу высоких тарифов, таможенная и пограничная охрана США (CBP) начала расследование мошенничества с страной происхождения, где китайские товары перемаркируются в Юго-Восточной Азии, а затем отправляются в США.

Вьетнам и Малайзия были основными объектами расследования.

Власти США требуют доказательства существенной трансформации продукции, экспортируемой из Юго-Восточной Азии.

Импортеры, не имеющие четкой документации, могут быть подвержены ретроактивным пошлинам, штрафам или конфискации товаров.

2. Новые тарифы на ключевые продукты

Хотя широкие тарифы, подобные тарифам на Китай, еще не действуют для стран Юго-Восточной Азии, целевые пошлины были введены в отношении конкретных категорий продуктов, связанных с китайскими избытком мощностей или проблемами национальной безопасности:

| страна | затронутый продукт | Тариф (2025) | сообразова |

| Вьетна | Солнечные батареи, батареи | 15–25% | Предполагаемые компоненты китайского происхождения |

| Малайзия | Алюминиевые экструзии | 18% (антидемпинговая пошлина) | Связано с перевалкой в Китай |

| Таиланд | Резиновые изделия, стальные трубы | 10–15% | избыточные, промышленные субсидии |

| Индонезия | определенные электронные компоненты | 12% | Национальная безопасность, прослеживаемость |

3. Стратегия США: shoring friends с осторожностью

Администрация Байдена продолжает продвигать «привязывание друзей» — поощрение смены цепочки поставок к доверенным партнерам, — но в 2025 году более четкий подход:

Юго-Восточная Азия по-прежнему рассматривается как производственный центр, но не застрахованный от правоприменения США.

Будущие тарифы могут быть нацелены на происхождение продукта, а не на происхождение страны, что делает нормативно-правовую документацию более важной, чем когда-либо

Американским покупателям и импортерам рекомендуется проводить аудит поставщиков, происхождение компонентов и анализ сертификации FTA.

Тарифы на товары из Юго-Восточной Азии, первоначально сделанные в Китае

В 2025 году правительство США усилило правоприменение в отношении переваленных товаров — продуктов, первоначально сделанных в Китае, но проходящих через страны Юго-Восточной Азии, чтобы избежать высоких тарифов. Эта практика, считающаяся формой обхода тарифов, в настоящее время подвергается агрессивной нацелке на таможенную и пограничную охрану США (CBP) и Министерство торговли.

1. Основные политики и тенденции в области правоприменения

Проверка страны происхождения: США требуют, чтобы импортеры предоставили доказательства того, что товары претерпели существенные преобразования в третьей стране (например, во Вьетнаме, Малайзии) для квалификации некитайского происхождения.

Отслеживание тарифов по разделу 301: продукты, подозревающие в китайском происхождении, даже если они перемечены или собраны в Юго-Восточной Азии, могут быть подлежат тарифам до 145% в соответствии с действующими тарифными графиками Китая.

Ретроактивные пошлины и конфискация: Импортеры, пойманные на нарушении правил происхождения, сталкиваются с ретроактивными пошлинами, финансовыми штрафами или даже конфискацией отгрузок в портах США.

Контроль FTA: товары, требующие статуса беспошлинной торговли в соответствии с правилами американского Вьетнама или США-АСЕАН, теперь подлежат повышению требований к аудиту и документации.

2. Влияние на глобальные цепочки поставок

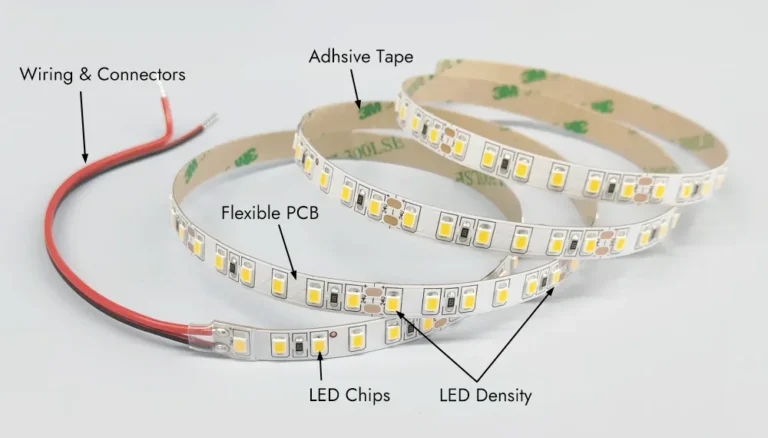

Производители Юго-Восточной Азии, которые полагаются на китайское сырье или компоненты (например, алюминий, печатные платы, светодиодные чипы) теперь должны раскрывать процессы происхождения и трансформации

Импортеры США находятся под давлением, чтобы проверить поставщиков и пересмотреть производственные следы, чтобы снизить юридические и финансовые риски.

Продукты без четкой отслеживаемости могут потерять тарифные льготы, даже если они будут закончены в странах АСЕАН.

3. Пример случая: светодиодные ленты

Светодиодные ленты являются ярким примером того, как эта проблема влияет на реальную торговлю.

Обычная практика: многие светодиодные ленты собираются во Вьетнаме или Таиланде, но используют светодиодные чипы, алюминиевые профили и печатные платы.

Таможенная позиция США (2025 г.): Если компоненты просто собраны и не преобразованы существенно (т. е. без существенного изменения формы, функции или стоимости), продукт по-прежнему рассматривается как «сделано в Китае» и при условии полного тарифа по разделу 301 — до 145%.

Стратегия соответствия:

Американские импортеры должны запросить вексель материалов (BOM), производственные блок-схемы и сертификаты происхождения.

Поставщики должны продемонстрировать, что производственный процесс в Юго-Восточной Азии меняет существенный характер продукта.

Некоторые импортеры переходят на полностью локализованную продукцию в АСЕАН или Мексике, чтобы снизить риск.

Ключевые выводы для импортеров

Всегда проверяйте происхождение и глубину обработки компонентов в третьей стране.

Не полагайтесь только на ярлыки или счета — CBP требует производственного доказательства.

Для деликатных категорий продуктов, таких как светодиодное освещение, солнечные модули, электроника, проактивное соответствие теперь необходимо.

Как избежать тарифных рисков в 2025 году – стратегические советы для импортеров

В связи с тем, что в 2025 году тарифная политика США становится более сложной и агрессивной, импортеры сталкиваются с новым набором рисков — не только по ставкам пошлины, но и в документации, соблюдении требований и отслеживаемости цепочки поставок. Чтобы оставаться конкурентоспособными и свести к минимуму финансовое воздействие, крайне важно работать с правильными поставщиками и применять стратегическую закупку подхода.

Вот основные стратегии для импортеров США по снижению рисков, связанных с тарифами, при сохранении качества, времени выполнения заказа и экономической эффективности:

1. Выбирайте поставщиков, которые могут предложить гибкость и ценность

Не все китайские поставщики равны. Правильный партнер может помочь вам впитать некоторые из влияния тарифов:

Готовность делиться затратами: поставщики высшего уровня могут предлагать корректировку цен, разделение затрат по тарифам или реструктуризацию ценообразования для поддержания стоимости земли.

Гибкие условия оплаты: Переговоры по условиям оплаты (например, частичная оплата после доставки, LC или OA) помогает управлять денежными потоками в условиях высокой нагрузки.

Стабильная политика обмена курсами: Поставщики, которые хеджируют валюту или предлагают цены в долларах США, могут защитить вас от колебаний юаней.

2. Расставьте приоритеты поставщиков с высокой производительностью и быстрой доставкой

В нестабильной глобальной среде время выполнения — это деньги. Поставщики, которые могут ускорить сроки производства и поставки, дают вам реальное преимущество:

Более короткий срок действия = меньший риск запасов: быстрое производство помогает снизить затраты на складское хозяйство и избежать задержек во время таможенного оформления или изменения полиса.

Заводы большой емкости: избегайте перебронированных или сезонных фабрик, которые не могут быстро масштабироваться, особенно важны во время тарифных окон или торговых споров.

Внутреннее производство: Поставщики со своими собственными предприятиями (а не аутсорсинг всего) как правило, более надежны и лучше контролируют качество.

3. Обеспечьте качество при оптимизации цены

Стоимость сокращения не должна означать срезы углов. Таможня США теперь более чем когда-либо тщательно изучает документацию и качество:

Полные записи КК: выбирайте поставщиков, которые могут предоставлять полные отчеты об инспекциях, сертификаты материалов и файлы соответствия.

Интегрированная цепочка поставок: поставщики, которые контролируют свою собственную спецификацию (например, печатные платы, алюминиевый профиль, светодиодный чип), лучше оборудованы для обеспечения стабильного качества и снижения затрат на компоненты.

Возможность тестирования: ищите партнеров с тестами на старение, отчетами IES и валидацией третьих лиц, особенно для таких продуктов, как светодиодное освещение.

4. Оценить возможности диверсификации риска Юго-Восточной Азии.

Чтобы уменьшить зависимость от товаров китайского происхождения, спросите, есть ли у вашего поставщика операции или партнерские отношения в Юго-Восточной Азии:

Вьетнам, Малайзия или Таиланд: эти места могут помочь сократить дежурство, если продукты претерпевают реальную трансформацию.

Возможности OEM за границей: некоторые китайские производители управляют совместимыми объектами за рубежом. Эта установка может помочь вам оставаться в тарифной эффективности при работе с известным поставщиком.

Проверьте соответствие: всегда убедитесь, что эти зарубежные товары могут доказать трансформацию происхождения, чтобы избежать штрафов за перевалку США.

5. Оптимизируйте стратегию грузоперевозок по стоимости и скорости

Доставка играет важную роль в стоимости вашего земельного участка. Умный план логистики может помочь вам сэкономить даже в условиях высокой тарифной среды:

Консолидированная доставка: Используйте полные контейнерные нагрузки (FCL) или консолидацию ступицы, чтобы снизить затраты на единицу продукции.

Ближай портовый склад: сокращает время доставки внутренне и позволяет быстрее реагировать на таможенные услуги.

Стратегия с двумя портами: избегайте перегруженных портов или тех, которые находятся под пристальным вниманием, распределяя грузы по нескольким точкам входа.

Резюме для покупателей США в 2025 году

| область фокусировки | важнейшее сооб |

| Выбор поставщика | Гибкость в ценообразовании, условиях оплаты, проверенном контроле качества |

| Производственная мощность | Может масштабироваться быстро, сжимать время выполнения, стабильный рабочий процесс |

| качество продукции | Документация-готова, протестирована и отслеживаема компоненты |

| Варианты Юго-Восточной Азии | доступно и услужливый Производство третьих стран |

| Оптимизация логистики | Более низкая стоимость за единицу за счет более умных грузов + более быстрый клиренс |

Переосмыслив отношения с поставщиками и оптимизируя ваши решения по добыче, импортеры могут поддерживать норму прибыли, избегать штрафов и оставаться конкурентоспособными — даже несмотря на рост тарифных рисков.

Как SignLite помогает снизить влияние тарифов для наших клиентов

В SignLite мы понимаем, как растущие тарифы США создают неопределенность и давление издержек для наших глобальных партнеров. Как ведущий производитель в индустрии светодиодных лент, мы стремимся помочь нашим клиентам снизить риски и защитить их маржу — даже в условиях нестабильной торговли.

1. Сильный рычаг поставщика для контроля затрат

Благодаря большому объему экспорта и давним отношениям с ключевыми поставщиками сырья SignLite обладает значительной покупательной способностью. Это позволяет нам:

Договоритесь о более высоких ценах на светодиоды, печатные платы, алюминиевые профили и драйверы.

Поглотите часть повышенной стоимости тарифа, чтобы облегчить нагрузку на наших клиентов.

Предоставлять более стабильные и предсказуемые котировки в неопределенные периоды.

Мы не просто сносим затраты вниз по цепочке поставок — мы работаем как партнеры, находя беспроигрышные решения.

2. Надежное качество, всегда на первом месте

Тарифные вопросы могут приходить и уходить, но качество продукции никогда не должно быть скомпрометировано. На знак:

Каждая светодиодная лента проверяется и состарена перед отправкой.

Мы поддерживаем полную прослеживаемость с помощью записей контроля качества, отчетов об испытаниях IES и документации по спецификации.

Мы помогаем клиентам избегать таможенных удержаний и отказов продуктов, что экономит вам гораздо больше, чем просто тарифные сборы.

Доверие построено на последовательности, и мы серьезно относимся к этой ответственности.

3. Высокая производственная мощность для захвата окон ГРМ

Благодаря нашим передовым производственным линиям и квалифицированным командам SignLite может быстро масштабироваться, когда появляются возможности, особенно во время окон приостановки тарифов.

Мы способны работать сверхурочно, чтобы выполнить срочные заказы.

Гибкое планирование позволяет нам расставлять приоритеты по времени доставки.

Клиенты получают критическое преимущество, отправляя товары до того, как вступят в силу новые обязанности.

Эта способность «быстрого движения» помогла многим партнерам минимизировать непредвиденные расходы.

4. Стратегическая логистическая поддержка для лучших тарифов на доставку

В 2025 году ограниченное количество мест доставки и заторы портов вызывают реальную озабоченность. Команда логистики Signlite имеет глубокие связи с экспедиторами и перевозчиками, что позволяет нам:

Обеспечьте обеспеченность по конкурентоспособным ценам, даже в пиковые сезоны.

Предлагайте варианты доставки нескольких портов, чтобы снизить риск и время выполнения заказа.

Координируйте полную нагрузку контейнера (FCL) или LCL-консолидацию для оптимизации стоимости единицы продукции.

Мы не просто производим — мы обеспечиваем спокойствие.

Партнер с доверенным поставщиком в неопределенное время

В Signlite мы делаем больше, чем делаем светодиодные ленты, йо- Мы помогаем нашим клиентам с уверенностью ориентироваться в сложных условиях глобальной торговли. От поддержки ценообразования до быстрой координации производства и логистики мы стремимся быть долгосрочным партнером, а не просто поставщиком продуктов.

Поможем свести к минимуму тарифные риски и максимизировать стоимость.

Свяжитесь с нашей командой сегодня, чтобы обсудить ваш проект, получить бесплатное предложение или запросить готовый каталог продуктов.

Последние новости о тарифах: меры США по Канаде, Мексике и металлам

По состоянию на середину 2025 года правительство США продолжает расширять свои тарифы за пределы Китая, при этом новые пошлины затрагивают североамериканские партнеры и ключевые промышленные материалы.

Ключевые сроки последних тарифных действий:

8 апреля 2025 г.

США вводят тариф 10% на избранные канадские алюминиевые продукты, со ссылкой на соображения национальной безопасности в соответствии с разделом 232.

Затронутые продукты: полуфабрикаты алюминий, профили экструзии.

12 апреля 2025 г.

Новый тариф 15% на мексиканскую стальную продукцию объявил из-за опасений по поводу перевалки китайского металла через Мексику.

Начаты специальные аудиты для отслеживания соответствия Origin.

15 апреля 2025 г.

США расширяют тарифы по разделу 232 на стальную и алюминий, добавляя 25% на холоднокатаную сталь и 15% на алюминиевые листовые изделия из разных стран, включая Вьетнам и Индию.

1 мая 2025 г.

Канада и Мексика совместно протестуют против принятия решения по тарифам США в ВТО, назвав их неоправданными и несовместимыми с обязательствами USMCA.

Эти недавние шаги сигнализируют о том, что США занимают более агрессивную позицию в отношении торговли как в дружественных, так и в состязательных странах. Импортеры должны внимательно следить за обновлениями и соответствующим образом корректировать стратегии поиска поставщиков.