Since the United States imposed additional tariffs on Chinese exports, many LED strip manufacturers have shifted part of their production to Vietnam to reduce landed costs and remain competitive. In 2025, this trend has become more pronounced, with both Chinese and Vietnamese facilities playing crucial roles in global supply chains. This report provides a structured cost comparison between manufacturing LED strips in China and Vietnam, analyzing key factors such as materials, labor, overhead, logistics, and compliance. The goal is to help buyers and project managers make informed sourcing decisions in a shifting trade environment.

Overhead & Factory Operations

Factory overhead is a significant contributor to overall manufacturing cost. In China, land acquisition and facility construction in industrial zones require higher upfront investment, and monthly rental rates in coastal cities are among the highest in Asia. Vietnam offers comparatively lower entry barriers, with land-use costs and rental expenses averaging around two-thirds of equivalent facilities in China. Utility expenses follow a similar pattern: electricity and water tariffs in Vietnam are generally 20–30% lower, though occasional supply interruptions can affect consistency. Equipment depreciation and maintenance costs remain similar, as most production lines rely on imported SMT machines from the same suppliers. Overall, Vietnam provides a cost advantage in overhead and operations, but Chinese plants offer more reliable infrastructure and supporting services, which may offset part of the savings in long-term production.

Labor & Assembly Costs

Labor remains one of the most visible cost differentiators between China and Vietnam. In 2025, the average monthly base wage for an electronics assembly worker in China ranges from USD 600–700 in coastal provinces, with overtime and benefits pushing total monthly cost closer to USD 800–850. In Vietnam, comparable workers earn USD 350–450 per month, with overtime rates significantly lower, resulting in a total labor cost of roughly half that of China.

However, productivity differences narrow this gap. Chinese workers generally achieve higher throughput due to greater industry experience, standardized processes, and higher adoption of automated SMT lines. Many Chinese factories run with 60–70% automation in LED strip assembly, while Vietnamese plants often rely on semi-automated or manual processes, leading to longer cycle times and higher rework rates.

In conclusion, Vietnam offers cheaper labor on paper, but China’s efficiency and automation reduce the per-unit labor cost advantage, especially in high-volume, quality-sensitive projects.

| Factor | China (2025) | Vietnam (2025) | Relative Impact |

| Base wage (monthly) | USD 600–700 | USD 350–450 | Vietnam ~60% of China |

| Overtime & benefits | USD 200+ | USD 80–120 | Cheaper in Vietnam |

| Automation level | 60–70% | 30–40% | China more efficient |

| Overall unit labor cost | Higher per worker, lower per unit | Lower per worker, higher per unit | Mixed outcome |

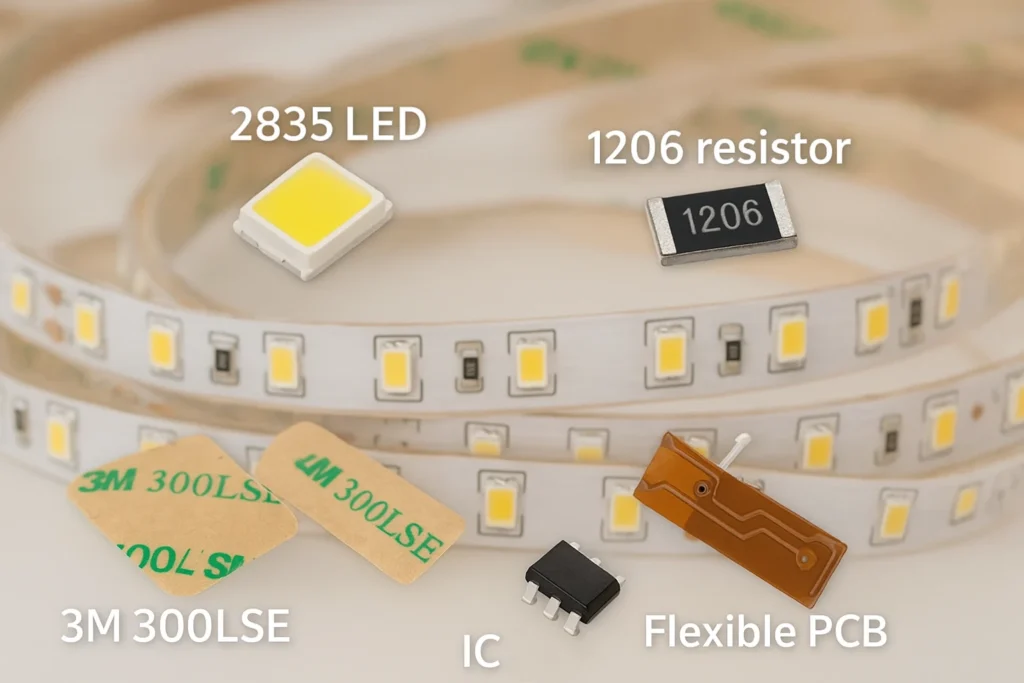

Material & Component Costs

The bill of materials represents the largest share of LED strip production costs, and here China maintains a clear structural advantage. LED chips, resistors, capacitors, and driver ICs are mostly sourced domestically in China, benefiting from competitive pricing and immediate availability. Flexible PCBs are also widely produced in Chinese manufacturing hubs, with economies of scale that keep costs lower. Aluminum profiles, diffusers, and thermal adhesives are similarly abundant, supported by a dense local ecosystem of extrusion and chemical suppliers.

By contrast, Vietnam’s LED strip factories rely heavily on imported inputs. While local PCB and mechanical parts production is gradually emerging, high-quality LED diodes, COB packages, and smart control ICs are still shipped from China. Even essential items such as silicone coatings and structural adhesives are imported, leading to longer lead times and additional logistics costs.

In practical terms, Vietnamese factories operate primarily as assembly sites. They provide competitive labor and overhead savings, but the majority of their material base continues to be Chinese, underscoring China’s central role in the LED strip supply chain.

Logistics & Trade Factors

China maintains strong infrastructure advantages, with world-class ports such as Shenzhen, Shanghai, and Ningbo ensuring predictable shipping schedules and competitive freight rates. Lead times for full-container loads are typically shorter due to mature export procedures and dense carrier networks. Vietnam’s logistics costs are slightly lower for inland transport and port handling, but its ports face capacity constraints, which can occasionally cause delays. For small and medium shipments, China’s flexibility and established forwarder ecosystem remain superior.

For the U.S. market, tariffs continue to shape sourcing decisions. Chinese-made LED strips are subject to additional duties, which can increase landed costs by 15–25%. Vietnam, by contrast, currently benefits from tariff exemptions or lower duty rates under existing trade agreements, making it a preferred option for American importers. For Europe and other regions, tariff pressure is minimal, and buyers tend to prioritize supply chain reliability and product quality over origin.

Vietnam provides U.S. buyers with a cost edge through tariff relief, while China remains competitive globally due to efficiency, scale, and mature logistics. The optimal choice depends largely on target market and volume requirements.

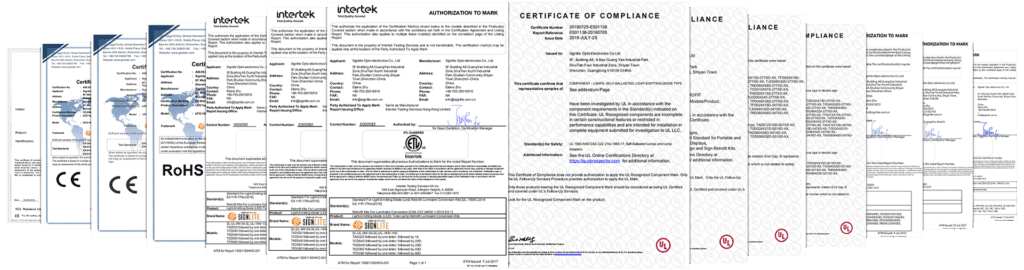

Compliance & Certification Costs

Certification expenses are another factor in total cost. In China, established laboratories and long experience with UL, ETL, CE, and RoHS testing allow manufacturers to complete compliance procedures quickly and at lower rates, often bundled with production services. Vietnam’s testing infrastructure is less developed; many factories must send samples abroad or to China for certification, adding both time and cost. While the direct fee difference may be moderate, the efficiency gap means China remains more attractive for projects requiring rapid certification and frequent product updates.

Total Landed Cost Scenarios

Cost competitiveness shifts with order size. For small batches, China’s higher labor and overhead push unit costs upward, but its faster sourcing and lower defect rates often justify the premium. In larger volumes, Vietnam’s labor savings and tariff advantages for U.S. buyers create a meaningful gap, although reliance on imported materials narrows the difference.

| Scenario | China (2025) | Vietnam (2025) | Key Takeaway |

| Small batch (≤500 units) | Higher unit cost, faster lead time | Lower labor cost, longer sourcing lead | China stronger for prototypes, urgent orders |

| Large batch (≥5,000 units) | Economies of scale, stable quality | Labor savings + U.S. tariff relief | Vietnam competitive for U.S. market |

Conclusion

China and Vietnam each offer cost advantages, but the best sourcing choice depends on market destination and project scale. Vietnam provides tariff relief for U.S. buyers and competitive labor costs, while China maintains unmatched strengths in materials, automation, certification, and reliable logistics. At SignliteLED, our Chinese facilities deliver high efficiency, full in-house component sourcing, and proven quality systems that reduce hidden costs over time. For projects requiring fast turnaround, strict compliance, and consistent supply, China remains a dependable option. Contact SignliteLED today to discuss your LED strip requirements and receive a tailored cost analysis.