invoering

In het afgelopen decennium is COB LED-strips hebben een revolutie teweeggebracht in de verlichtingsindustrie en zijn de voorkeursoplossing geworden voor commerciële, retaildisplay en decoratieve interieurtoepassingen. Met superieure prestaties die worden gekenmerkt door een hoge lichtopbrengst (130-150 lm/W), uitzonderlijke kleurweergave (CRI 90+) en naadloze uniforme lichtopbrengst, hebben deze geavanceerde verlichtingsoplossingen nieuwe industriebenchmarks voor kwaliteit en efficiëntie vastgesteld.

De wereldwijde COB-markt voor LED-strips heeft een aanzienlijke groei laten zien, met een omvang van ongeveer 2,5 miljard dollar in 2023 en zou in 2030 naar verwachting uitbreiden tot 5,5 miljard dollar, wat neerkomt op een CAGR van 121 TP3T. Deze groei wordt met name gedreven door retaildisplay en commerciële verlichtingstoepassingen, die samen goed zijn voor meer dan 601 TP3T van de marktvraag.

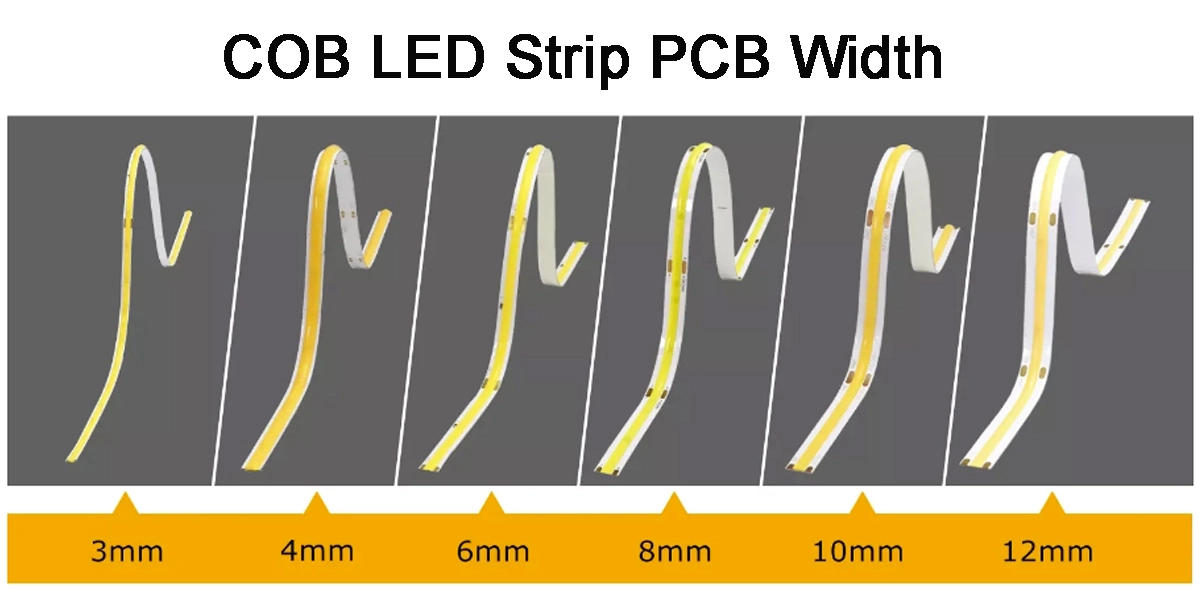

Naarmate de marktacceptatie versnelt, is de wereldwijde toeleveringsketen aanzienlijk gediversifieerd. Variaties in PCB-breedte (2,7-14 mm), LED-dichtheid (320-720 chips/m) en verpakkingsformaten bieden zowel kansen als complexiteit voor kopers. Aanzienlijke prijsverschillen weerspiegelen onderliggende kwaliteitsverschillen, met kosten per meter variërend van $0.5 voor basisconfiguraties tot meer dan $5 voor premiumspecificaties.

Deze variaties zijn direct toe te schrijven aan kritische factoren, waaronder LED-chipkwaliteit, PCB-ontwerp en materiaalkwaliteit, lichtgevende werkzaamheid, kleurweergave-index, kleurtolerantie (SDCM 2-5) en garantievoorwaarden.

Deze analyse biedt inkoopteams, ingenieurs en lichtspecificaties van uitgebreide inzichten in de huidige prijsstructuren in zowel consumentenretail- als professionele groothandelsmarkten. Het document onderzoekt supply chain-factoren - van materiaalselectie en productieprocessen tot garantiebeleid - die uiteindelijk de productprestaties en de totale eigendomskosten bepalen.

Lezers zullen bruikbare informatie krijgen over prijs-prestatieverhoudingen van toonaangevende oplossingen en begrijpen de praktische implicaties van technische specificaties voor verschillende toepassingen. Deze referentie maakt weloverwogen besluitvorming mogelijk voor commerciële verlichtingsprojecten, verbeteringen in de detailhandel en scenario's voor volume-inkoop, waardoor een optimale waardeselectie wordt gegarandeerd op basis van specifieke projectvereisten en budgetbeperkingen.

Vergelijkende analyse van C-End & B-End Markets en Procurement Guide

De C-End Retail Market en de B-End Engineering-markt voor COB LED-strips vertonen duidelijke verschillen in productpositionering, prestatiebenchmarks en prijslogica. Het C-end richt zich voornamelijk op individuele gebruikers en kleine bedrijven en biedt transparante en toegankelijke prijzen. Daarentegen richt de B-End zich op grootschalige projecten en professionele verlichtingstoepassingen, waarbij langetermijnstabiliteit en totale eigendomskosten (TCO) belangrijke overwegingen zijn. Door deze verschillen te begrijpen, kunnen kopers nauwkeuriger beslissingen nemen in zowel productselectie als kostenbeheer.

Vergelijking van belangrijke marktprijsfactoren

C-End Marktprijsfactoren

De prijzen in de c-end-markt worden grotendeels bepaald door de initiële aankoopkosten en de waargenomen waarde.

- PCB-breedte en dichtheid: Smalle planken (≤8mm) en modellen met lage dichtheid domineren, geschikt voor flexibele installatie.

- Lichtgevende werkzaamheid & CRI: 80 CRI en ~120 lm/W zijn mainstream; producten met CRI 90 hebben doorgaans een merkbare premie.

- Kleurconsistentie: Kleurtolerantie (SDCM) wordt vaak over het hoofd gezien of niet gespecificeerd, wat leidt tot mogelijke variaties tussen batches.

- Merk & Garantie: Internationale consumentenmerken hebben hoge premies. Garantieperiodes variëren meestal van 1-3 jaar, met inconsistente handhaving.

B-End Marktprijsfactoren

Prijzen in de B-end-markt zijn gebaseerd op prestatiegarantie, levenscycluskosten en projectrisicobeperking.

- PCB-breedte en dichtheid: Bredere planken (8 mm, 10 mm, 12 mm en meer) met een hogere dichtheid zijn standaard, wat zorgt voor een effectieve warmteafvoer en een langere levensduur.

- Lichtgevende werkzaamheid & CRI: CRI 90 (met R9 >50) en hoge werkzaamheid boven 140-160 lm/W zijn basisvereisten. Geavanceerde statistieken zoals TM-30-20 (RF, RG) winnen aan belang.

- Kleurconsistentie: Strenge tolerantievereisten (SDCM ≤3, in sommige gevallen ≤2) zorgen voor exacte kleurmatching tussen projectbatches.

- Merk & Garantie: Prijs weerspiegelt vertrouwen in technische ondersteuning, wereldwijde certificeringen en bewezen betrouwbaarheid. Garantievoorwaarden zijn doorgaans 5 jaar of langer.

Marktparameters en prijsvergelijking

Kernproductparameters en prijsvergelijking (op basis van 5M-reel / 24V, 480 LED's/m, 8 mm PCB)

| Parameter | C-end typische waarde | B-einde typische waarde | Opmerking |

| Prijs per meter | $0.5 – $4.0/M | $1.5 – $2.5/M | C-end inclusief goedkope REnEnL-tot-reel producten (<$1/M), terwijl premiummerken tot $4/M. B-end prijzen zijn meer geconcentreerd vanwege garantie- en certificeringskosten. |

| PCB Breedte | 3mm, 5mm, 8mm, 10mm | 8mm, 10mm, 12mm, 14mm | Bredere PCB's profiteren van warmteafvoer en mechanische stabiliteit in B-end-toepassingen. |

| LED Dichtheid | 320-480 LED's | 480-720 LED's | De B-end streeft naar een hoger lumenvermogen en extreme uniformiteit. |

| CRI | 80+ | 90+ (R9 >50) | De B-end heeft strenge eisen voor kleurgetrouwheid. |

| SDCM | ≤5(/≤3) | ≤3 (/≤2) | De B-end vereist een strikte kleurconsistentie om batchverschillen te voorkomen. |

| Garantie | 1-3 jaar | 3-5 jaar | B-End-garantie is een belangrijk onderdeel van de prestatiebelofte. |

| kernwaarde | Kostenprestaties & gemak | Betrouwbaarheid en totale eigendomskosten | Het fundamentele verschil in marktpositionering en prijslogica. |

Reel-to-reel COB LED-strips

Model: FYX08S480A/C

LED-aantal per meter: 480 chips

PCB Breedte: 8mm

Kleuroptie: 3000K/4000K/6500K

CRI: >80

Ingangsspanning: DC24V/DC12V

Vermogen per meter: 10,5 W/m

Efficiëntie: 90-110 lumen/watt

IP-klasse: IP20

Garantie: 2 jaren

Zij-uitstralende COB LED Strip Light

Model: FYX08S480C

LED-aantal per meter: 480 chips

PCB Breedte: 8mm

Kleuroptie: 2700K/3000K/4000K/6500K

CRI: >90

Ingangsspanning: DC24V

Vermogen per meter: 10W

Efficiëntie: 90-110 lumen/watt

IP-klasse: IP20

Garantie: 3 jaar

Toepassingsscenario's en inkoopadvies

Aanbevelingen voor het einde

Smaldraad / lage dichtheid: Home Cabinet Lighting, doe-het-zelf decoratieprojecten, kleine vitrines.

Medium board / medium dichtheid: kleine winkels, cafés, residentiële accentverlichting.

B-einde aanbevelingen

Breed board / hoge dichtheid: high-end winkels, openbare ruimtes van het hotel, lineaire verlichting op het kantoor, musea en galerijen. Deze applicaties vereisen een onberispelijke lichtkwaliteit, betrouwbaarheid en stabiliteit gedurende de hele levenscyclus van het project.

Toeleveringsketen Kosten en waardeanalyse

Het prijsverschil tussen C-End en B-End COB LED-strips komt uit elke fase van de toeleveringsketen - van chipsourcing en PCB-materialen tot inkapselingsprocessen en garantiestructuren. Een gedetailleerde uitsplitsing laat zien hoe hogere kosten in B-end-producten zich vertalen in betrouwbaarheid en waarde op lange termijn voor professionele toepassingen.

Supply chain kosten chauffeurs

| Aspect | C-end kenmerken | B-einde kenmerken | Impact op waarde |

| LED-chip | Generieke chips met bredere binning-toleranties. | Premium chips van leveranciers zoals Nichia, Cree, Lumileds, strak weggegooid. | B-end chips zorgen voor een hoge werkzaamheid, lage lumen afschrijving en consistente kleur, waarborging van de projectkwaliteit aan de bron. |

| PCB-materiaal | FR-4 of standaard aluminium substraten met dun koper (0,5-1 oz). | Hoog-thermisch-geleiding aluminium (MCPCB) met dik koper (2-4 oz). | Dikkere koper en geavanceerde substraten zorgen voor een superieure warmteafvoer en huidige capaciteit, waardoor de levensduur van het product direct wordt verlengd. |

| inkapseling | Standaard epoxy of laagwaardige siliconen, gevoelig voor geel en degradatie. | Hoog transparant, anti-aging siliconen, bestand tegen UV en hoge temperatuur. | B-End-inkapseling handhaaft lichtdoorlatendheid en kleurstabiliteit gedurende de hele levenscyclus van het product. |

| Productieproces | Basis matrijsverlijming en draadverlijming met lossere toleranties. Handmatige inspectie gemeenschappelijk; inkapseling minder consistent. | Volledig geautomatiseerde, zeer nauwkeurige matrijs- en draadverlijming, geautomatiseerd fosforspuiten/potten, AOI en 100% foto-elektrische tests. | Automatisering zorgt voor foto-elektrische consistentie, betrouwbaarheid van draadverbindingen en elimineert risico's van kleurverschuiving, donkere zones en vroege mislukkingen - cruciaal voor projectuniformiteit. |

| Garantie logica | Garantie vaak alleen op basis van fysieke storing. | Garantie gekoppeld aan prestaties, gewoonlijk L70/B50 >50.000 uur met 3-5 jaar lumen onderhoud. | B-End-garanties fungeren als contractuele prestatieverplichtingen, waardoor TCO en MaintenanC worden verlaagd |

Geavanceerde verpakkingstechnologieën: COB en zijn evoluties

COB Packaging blijft de reguliere oplossing voor lineaire verlichting, maar blijft evolueren naar nieuwe formaten. Deze innovaties zijn bedoeld om de lichtgevende werkzaamheid, thermisch beheer en optische controle te verbeteren, waardoor kopers opties krijgen die zijn afgestemd op verschillende toepassingsvereisten.

| technologie | Beschrijving & kenmerken | Voordelen | Gemeenschappelijke toepassingen & markt |

| COB (Chip-on-Board) | Meerdere LED-chips direct op het substraat verpakt en vormen een dicht, continu lichtoppervlak. | Uitstekende kleuruniformiteit zonder zichtbare korreligheid, compacte structuur, lagere thermische weerstand (directe substraatverbinding). | Veel gebruikt in commerciële, retail en decoratieve verlichting; dominant in zowel c-end als b-end markten. |

| CSP (chipsschaalpakket) | Verpakte grootte bijna gelijk aan de chip zelf, gemonteerd zonder gouden draden. Functioneert als een geminiaturiseerde SMD. | Hoge lumendichtheid, uitstekend thermisch pad, maakt compacte armatuurontwerp mogelijk. | Nichetoepassingen die extreme miniaturisatie vereisen (bijv. Automotive, Flash, projectoren). Zeer klein aandeel in de stripmarkt. |

| Scob (flip-chip COB) | COB met behulp van flip-chip-elektroden die direct aan substraatpads zijn gehecht, waardoor gouden draden worden geëlimineerd. | Hogere betrouwbaarheid (geen storingen in de draadverbinding), superieure thermische prestaties, ondersteunt hogere aandrijfstromen. | Premium B-end use cases: Automotive koplampen, buiten armaturen, industriële verlichting. |

| SOB (blad-on-board) | Een enkele fosforplaat bedekt de chip-array en vervangt gedisponeerde fosforlijm. | Uitzonderlijke kleurconsistentie door ongelijke fosforlagen te vermijden; vereenvoudigde productie. | Ultra-high-end commercieel, museum en filmverlichting waar ultieme kleuruniformiteit vereist is. klein maar groeiend marktsegment. |

Ontwikkelen van de optimale inkoopstrategie: van kostenanalyse tot waardeinvestering

Kernbeslissingskader: Total Cost of Ownership (TCO)

Bij commerciële verlichtingsprojecten is de aankoopprijs van een COB LED-strip slechts het startpunt. De echte waardemaatstaf ligt in de Total Cost of Ownership (TCO), die elke fase van de levenscyclus van het product dekt, van aankoop en installatie tot energieverbruik en onderhoud. TCO is de maatstaf voor het evalueren van het rendement op investering.

Initiële aankoopkosten: vooraf kosten voor strips, chauffeurs en accessoires.

Installatiekosten: arbeid en installatiecomplexiteit, zoals herbedradingsvereisten.

Energiekosten: langetermijnelektriciteitsuitgaven, gebaseerd op lichtgevende werkzaamheid (LM/W) en lokale tarieven. Producten met een hoog werkzaamheidsverschil verdienen vaak hun prijsverschil binnen 1-2 jaar door energiebesparing.

Onderhouds- en vervangingskosten: dekt faalpercentages na de garantie, vervanging als gevolg van lumenafschrijving en mogelijke verliezen aan uitvaltijd - vaak de meest verborgen maar kostbare factor.

Tabel: TCO Vergelijkende Analyse Voorbeeld (5-jaarscyclus)

| Kostenartikel | Economie optie | Professionele optie |

| Initiële aankoopkosten | $500 | $1,500 |

| Energiekosten | $800 | $600 |

| Onderhoudskosten | $400 | $0 (binnen garantie) |

| Geschat verlies van downtime | $300 | $0 |

| 5-jaar TCO | $2,000 | $2,100 |

Inkoopbeslissingsmatrix: uw ideale product lokaliseren

Om inkoop te vereenvoudigen, worden deze matrix afgestemd op technische specificaties, toepassingsscenario's en budgetniveaus, waardoor afwegingen tussen kosten, prestaties en waarde op lange termijn transparanter worden.

Tabel: COB LED Strip Inkoopbeslissingsmatrix

| Categorie | kostengedreven | harmonisch | geneesd |

| Toepassing | Home DIY, magazijnen, gangen | Kleine winkels, cafés, kantoren | High-end detailhandel, hotels, musea |

| Belangrijkste specificaties | CRI 80+, SDCM ≤7 | CRI 85+, SDCM ≤5 | CRI 90+ (R9 >50), SDCM ≤3 |

| Prijsklasse ($/M) | $0.5 – $1.5 | $1 – $3 | $2 – $5+ |

| waarde propositie | Laagste initiële investering | Beste kosten-prestatieverhouding | Laagste TCO, risicobeperking |

Scenario-based inkoopgids

Voor projecteigenaren en managers: het wordt aanbevolen om een TCO-analyse voor te bereiden voor commerciële kerngebieden zoals flagshipstores of grote winkelhallen. Dit verschuift de beslissing van een "kostenkosten" naar een "waarde-investering", wat het gebruik van premium COB-LED-strips rechtvaardigt.

Voor ontwerpers en ingenieurs: specificeer kritische parameters (bijv. CRI ≥90, SDCM ≤3) in technische documentatie en gebruik de beslissingsmatrix om aan te tonen hoe verschillende opties de projectresultaten en operationele kosten beïnvloeden.

Voor inkoopspecialisten: voer een "hybride strategie" in: implementeer evenwichtige producten in secundaire gebieden om het budget te controleren, terwijl u aandringt op hoogwaardige producten in kerngebieden om de algehele kwaliteit te garanderen.

Markttrends en toekomstvooruitzichten

Divergerende eindmarkttrends

C-End Markttrends:

Balanceren van kosten en kwaliteit: consumenten gaan verder dan prijsgedreven beslissingen. De vraag naar hoge CRI (90) en slimme besturingsfuncties (app-based dimmen en afstemmen) neemt snel toe, hoewel de prijsgevoeligheid blijft bestaan.

Gediversifieerde kanalen: online platforms domineren de verkoop, met videorecensies en getuigenissen van gebruikers die van invloed zijn op aankoopbeslissingen.

Groeiende doe-het-zelf-toepassingen: gepersonaliseerde huisverlichting voedt de groei van compacte, eenvoudig te installeren COB-strips.

B-End Markttrends:

Standaardisatie van vereisten: CRI 90, SDCM 3 en L90 >50.000 uur zijn nu basisspecificaties voor high-end projecten.

Geïntegreerde oplossingen: klanten vragen steeds vaker pakketten met optisch ontwerp, installatiebegeleiding en ondersteuning na verkoop.

Duurzaamheid: energiecertificeringen, milieuvriendelijke materialen en producten met een lange levensduur ondersteunen ESG-compliance in commerciële projecten zoals hotels, kantoren en gevelverlichting. Voor meer inzicht in waarom COB LED-strips de markt zullen domineren, zie ons volledige rapport over 2025 Verlichtingstrends: de verrassende opkomst van COB LED-strips.

Marktvolume, prijs en fabrikantdynamiek

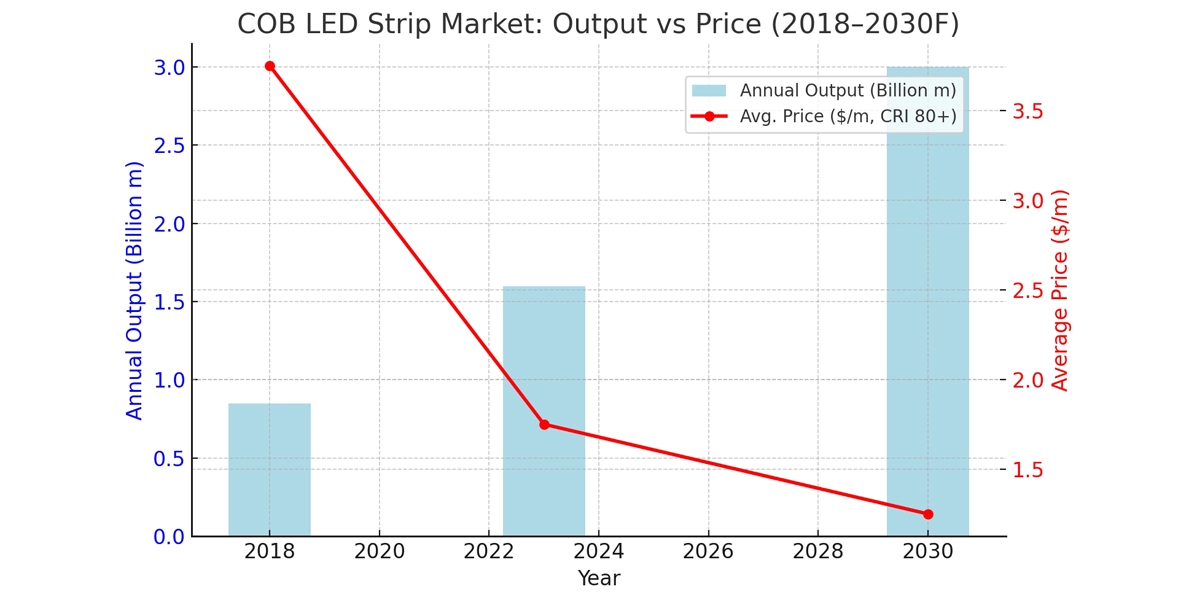

productie groei

De wereldwijde productie steeg van 850 miljoen meter in 2018 tot 1,6 miljard meter in 2023, aangedreven door retail- en decoratieve toepassingen. In 2030 zal het naar verwachting meer dan 3,0 miljard meter bedragen, in lijn met een 12% CAGR.

Prijs evolutie

De gemiddelde prijs van de reguliere COB-ledstrips (480 LED's/m, 8 mm PCB, CRI 80+) is gestaag afgenomen met schaalvoordelen en roll-to-roll-productie:

- 2018: USD 3.5–4.0 per meter

- 2023: USD 1,5–2,0 per meter

- 2030 (prognose): USD 1,0-1,5 per meter

Premium CRI 90+ producten handhaven een 30-40%-prijspremie, vooral in B-end-projecten die garanties van 5 jaar of langer vereisen. Voor een nadere blik op productniveau-innovaties en prestatieverschuivingen, bekijk ons artikel over COB LED Striptrends.

Leverancier Land

Het aantal actieve fabrikanten is gegroeid van ~200 in 2018 tot 400+ in 2023, voornamelijk in China. Tegen 2030 zal consolidatie ertoe leiden dat de top 20 spelers die >60%-marktaandeel bezitten, terwijl kleinere bedrijven overstappen op OEM/ODM-rollen.

Tabel 1: Productie-, prijs- en leverancierstrends (2018-2030F)

| Jaar | Jaarlijkse output (miljard m) | Gemiddeld. Prijs ($/M, CRI 80+) | Actieve fabrikanten | Marktstructuur |

| 2018 | 0.85 | 3.5–4.0 | ~200 | gedeeltelijk |

| 2023 | 1.6 | 1.5-2.0 | 400+ | zeer competitief |

| 2030V | >3.00 | 1,0-1,5 | Geconsolideerd (~20 domineren) | Top 20 >60% Delen |

Technologie evolutierichtingen

Efficiëntiewinsten: Continue verbeteringen in chipontwerp en fosformaterialen duwen de werkzaamheid van massaproductie naar 180-200 lm/W.

Doorbraken van kleurconsistentie: AI-gebaseerde binning- en SOB-verpakkingen maken nu grootschalige productie met SDCM 1,5 haalbaar.

Slimme integratie: COB-strips met geïntegreerde draadloze chips, omgevingssensoren en adresseerbare functies verleggen de grenzen van slimme verlichtingstoepassingen.

Thermisch beheer Innovatie: keramische substraten en thermo-elektrische scheidingsstructuren verbeteren het thermisch beheer aanzienlijk, waardoor ontwerpen met een hogere vermogensdichtheid mogelijk worden.

Voor een gedetailleerde vergelijking van verpakkingstechnologieën, waaronder COB, CSP, SCOB en SOB—En hun respectieve structurele kenmerken, fotometrische prestaties en aanpassingsvermogen van de installatie, kunt u deze uitgebreide kopersgids raadplegen als een aanvullende bron.

Opkomende toepassingsgebieden

Agrarische verlichting: Cob-strips met Tunable-Spectrum leveren nauwkeurige golflengteoplossingen voor verticale landbouw en kassen teelt.

Medische verlichting: High-CRI, flikkervrije COB-producten worden steeds vaker toegepast in chirurgische verlichting en zorginstellingen.

Automotive Lighting: Flexibele COB-strips winnen snel in de auto-interieur- en exterieursignaalverlichting. Film- en uitzendingsverlichting: COB-strips met hoge CRI en stabiliteit komen naar voren als voorkeursopties voor filmproductie en live-uitzendingen.

Tabel: Potentiële groei Marktvoorspelling 2024-2030

| Toepassingsgebied | Geprojecteerde CAGR | Belangrijkste drivers |

| Slimme huisverlichting | 15.20% | Intelligentie van het hele huis, persoonlijke verlichtingsvraag |

| Verticale landbouw | 22.50% | Voedselveiligheid, gelokaliseerde productie |

| Interieurverlichting | 18.70% | EV-adoptie, gepersonaliseerde ervaringen in de auto |

| Commerciële displayverlichting | 12.30% | Retail upgrades, merkdifferentiatie |

Competitief landschap en de productievoordelen van China

Wereldwijd concurrentielandschap

De wereldwijde COB-ledstripmarkt vormt een "dual-track concurrentie" -structuur.

Philips/Signify、Osram/Ledvance、cree

Focus op high-end B-end projecten (winkelcentra, hotels, musea, enz.). Ze behouden marktaandeel met merkpremie en certificeringssystemen, maar hun prijzen liggen aanzienlijk boven de industriegemiddelden.

Opkomende merken en platform white labels (Amazon, LEDsupply, enz.)

Serveer C-end en deel van de mid-to-low-end B-End Market. Ze hebben transparante prijzen en flexibele levering, maar missen vaak stabiliteit op lange termijn en consistentie van de partij.

Chinese fabrikanten

Snel stijgend door OEM/ODM-modellen, produceren Chinese fabrikanten niet alleen voor overzeese merken, maar bouwen ze ook hun eigen merken op en betreden ze geleidelijk de mid-to-high-end markt.

Kernvoordelen van Chinese productie

Complete toeleveringsketen

China heeft een complete industrieketen opgezet - van stroomopwaartse chips en verpakkingsmaterialen tot midstream-productie- en stroomafwaartse toepassingen - waardoor de doorlooptijden aanzienlijk worden verkort en de totale kosten worden verlaagd.

Kostenconcurrentie

Volgens equivalente specificaties zijn in China gemaakte COB-strips over het algemeen 30-50% goedkoper dan Europese en Amerikaanse merken, wat een hogere kostenprestatie biedt.

Aanpassingsvermogen

Ondersteuning van aanpassingen aan kleine batches en OEM/ODM-services, met monsterlevering in slechts 1-2 weken, voldoen aan snelle iteratie en uiteenlopende vereisten.

Certificeringen en naleving

De meeste exportgerichte bedrijven bieden CE, RoHS, UL, ETL en andere certificeringen, waardoor ze voldoen aan de internationale markttoegangsvereisten.

Casestudy's en gegevensondersteuning

Volgens douanestatistieken bedroeg de Chinese led-verlichtingsexport in 2024 meer dan USD 48 miljard, waarbij COB Linear Lighting het snelst groeiende segment was, geprojecteerd CAGR van meer dan 181 TP3T.

Europese winkelketens en Noord-Amerikaanse technische projecten nemen steeds vaker "Made in China"-cobstrips over als alternatieven of aanvullingen op internationale merken.

Aanbevelingen voor inkoop

Bij het selecteren van leveranciers moeten klanten zich richten op de volgende kernfactoren:

Transparantie in de toeleveringsketen: traceerbaarheid van grondstoffen en productieprocessen.

Productconsistentie: Batch-stabiliteit van belangrijke parameters zoals CRI en SDCM.

Ondersteuning na verkoop: duidelijk en goed geïmplementeerd garantiebeleid.

Regionale inzichten: Marktkenmerken per regio

Noord-Amerika

UL/ETL-certificeringen zijn verplicht voor de meeste commerciële projecten. Inkoopteams richten zich sterk op veiligheidsnormen en garantiehandhaving. De prijs is minder gevoelig in vergelijking met Europa of Azië, maar de betrouwbaarheid van de doorlooptijd is van cruciaal belang.

Europa

Naleving van CE-, ROHS- en ERP-energienormen is de belangrijkste drempel voor markttoetreding. Duurzaamheid en ESG-afstemming zijn sterke drijfveren; kopers geven vaak de voorkeur aan leveranciers met milieuvriendelijke materialen en gedocumenteerde inspanningen voor koolstofreductie.

Azië-Pacific (APAC)

Snelst groeiende markt met vraag geconcentreerd in retail, horeca en smart home-applicaties. Inkoop is zeer prijsgevoelig, maar snelle maatwerk en snelle leveringscycli worden gewaardeerd.

Midden-Oosten en Afrika (MEA)

Projecten benadrukken duurzaamheid en prestaties op hoge temperatuur als gevolg van barre klimaatomstandigheden. Grootschalige gastvrijheids- en infrastructuurontwikkelingen (bijv. luchthavens, winkelcentra) stimuleren de vraag naar hoogwaardige COB-oplossingen.

| landstreek | Certificeringspri | Aankoopfocus | Prijsgevoeligheid |

| Noord-Amerika | UL / ETL | Veiligheid, garantie, doorlooptijd | Medium |

| Europa | CE / RoHS / ERP | Duurzaamheid, ESG-compliance | middelhoog |

| APAk | Varieert (CCC, PSE, KC etc.) | Maatwerk, snelle levering | Hoog |

| maand | CE / lokale normen | Duurzaamheid, hoge temperatuurweerstand | Medium |

Conclusie

Deze analyse heeft systematisch de wereldwijde ontwikkeling van COB-LED-strips beoordeeld, die betrekking hebben op prijsstructuren, verschillen in de toeleveringsketen, technologische evolutie, applicatietrends en het concurrentielandschap. COB-strips zijn geëvolueerd van eenvoudige verlichtingscomponenten naar kritische oplossingen die upgrades stimuleren in commerciële verlichting, retaildisplays en opkomende toepassingen.

Voor kopers, ontwerpers en ingenieurs is het essentieel om de waarde achter prijsstelling te begrijpen en zich te concentreren op de prestaties van de levenscyclus - in plaats van alleen de initiële aankoopkosten - om het beste rendement op de investering te behalen. Tegelijkertijd wordt de Chinese productie, met zijn volledige toeleveringsketen en steeds volwassener wordende kwaliteitscontrole, een hoeksteen van de wereldmarkt.

Gedurende de komende 3-5 jaar, terwijl doorbraken in werkzaamheid, kleurweergave, consistentie en slimme integratie doorgaan, zullen COB-LED-strips nieuw potentieel ontsluiten in verschillende toepassingen. Van retaildisplays tot slimme huizen, van hoogwaardige commerciële projecten tot duurzame verlichtingsoplossingen, COB-technologie zal de industriestandaarden blijven hervormen en nieuwe waarde creëren in de wereldwijde verlichtingsmarkt.